The last few weeks saw a few surprises (at least in my eyes) in the ongoing race among EV-related companies to go public by merging with SPACs (special purpose acquisition companies). You can read my article on EV SPACs from December and view our table of public EV and AV companies or SPACs in the process of closing.

I had expected Proterra to merge with QELL, didn’t have Faraday Future on my radar, the timing of the EVgo deal was a little surprising, and I thought that Volta Charging might go the SPAC route instead of raising another round of funding. But various forms of financing seem to often be secured with or shortly before a SPAC. So stay tuned.

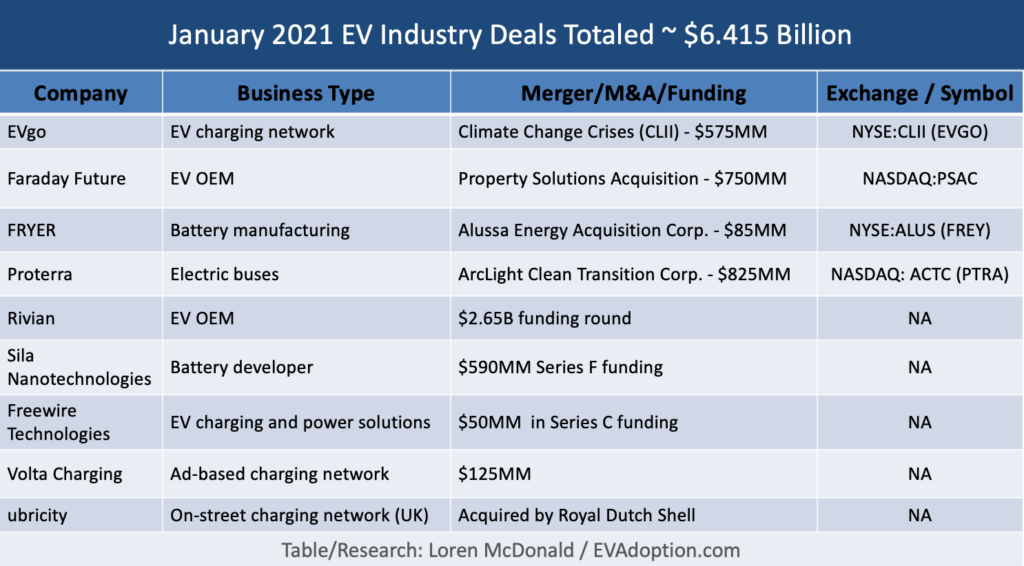

I identified nine major EV-related deals (IPOs, SPAC mergers, funding, and acquisitions) that were announced in January 2021, for an estimated total value of $6.415 billion. (Terms were not disclosed for the Shell/ubitricity deal.) And while nothing was announced regarding Lucid Motors, there was some news and update from the Saudi PIF fund director on its possible SPAC or IPO.

IPOs and SPAC Mergers

Climate Change Crises (CLII) To Merge With EVgo – On January 22, fast-charging network EVgo announced it would become a publicly-traded company through a merger with the Climate Change Crises SPAC. Details of the deal include (via MarketWatch):

- EVgo expects $575 million in proceeds from the merger

- Combined company valued at $2.6 billion.

- Deal expected to close in the Q2 of 2021

- Combined company will be named EVgo Inc.

- Stock will trade under the ticker symbol “EVGO”

Proterra To Merge With ArcLight Clean Transition Corp., (ACTC) SPAC – Burlingame, CA electric bus maker is going public through a SPAC merger with ArcLight Clean Transition Corp., and the transaction is expected to raise $825 million in cash and with an enterprise value of $1.6 billion.

The transaction included $415 million in private investment in public equity commitments led by Daimler Trucks, as well as Franklin Templeton, Chamath Palihapitiya, Fidelity Management & Research, and funds and accounts managed by private equity firm BlackRock. The company has raised about $682 million from investors including Kleiner Perkins, Daimler, Generation Investment Management, Tao Capital Partners, Soros Fund Management, Cowen Sustainable Advisors, GM Ventures, and utility Exelon’s Constellation power retailing unit.

The transaction is expected to close in the first half of 2021 and on completion of the merger, Proterra will trade under the ticker symbol PTRA. – GreenTech Media

Faraday Future to Merge With Property Solutions Acquisition (PSA) – This deal took me a bit by surprise as it is a combination of a real estate targeted SPAC and the struggling luxury EV maker Faraday Future. Property Solutions brings about $230 million in cash; a PIPE (private investment in public equity) funded by outside investors adds another $775 million. Faraday is expected to net about $750 million after fees and expenses. – Motley Fool

FREYR, Battery Cells Developer FREYR, to Merge With SPAC, Alussa Energy Acquisition Corp. – FREYR, a Norway-based developer of battery cell production capacity, is becoming a publicly listed company through a business combination with Alussa Energy Acquisition Corp. (Source: press release)

- Upon closing, the combined company will be renamed “FREYR Battery” and be listed on the New York Stock Exchange under the new ticker symbol “FREY”

- FREYR is expected to receive approximately $850 million in equity proceeds as a part of the business combination, enabling the company to accelerate the development of up to 43 GWh of clean battery cell manufacturing capacity in Norway by 2025

- Transaction includes a $600 million fully committed PIPE

- Pro forma equity value of the combined company would be approximately $1.4 billion.

Lucid Motors IPO/SPAC Decision Imminent – While there was no formal news on the rumored SPAC merger between Lucid Motors and Churchill Capital Corp. IV (CCIV), the head of the Saudi PIF that owns a majority of Lucid, shared on CNBC that the Newark-based company’s board was discussing and would soon reach a decision on whether to do a regular IPO or merge with a SPAC. There are also reports that the PIF is in negotiations with Lucid around a production facility in the city of Jeddah, which could be delaying the IPO versus SPAC decision.

Funding/Investments

Rivian Raises $2.65 Billion – The startup make of the R1T electric pickup, R1S SUV, and Amazon delivery van raised another $2.65 billion, bringing the total to $8 billion since the start of 2019. The round, which was led by funds and accounts advised by T. Rowe Price Associates Inc., also included Fidelity Management and Research Company, Amazon’s Climate Pledge Fund, Coatue and D1 Capital Partners as well as several other existing and new investors.

Rivian is now valued at $27.6 billion, according to a person familiar with the investment round. – TechCrunch

Coatue and T. Rowe Price Funds Anchor $590M Investment in Sila Nanotechnologies – Alameda, CA-based battery materials company Sila Nanotechnologies, announced that it raised $590 million Series F funding at a $3.3 billion post-money valuation. Sila Nano will use the funds to begin development of a new North American 100 GWh plant to produce its silicon-based anode material and serve smartphone and automotive customers. The company has partnerships with BMW and Daimler, aims to start production at the new plant in 2024 and powering electric vehicles by 2025. – Sila Nanotechnologies press release

FreeWire Technologies Secures $50M in Series C Funding – San Leandro, Calif.-based provider of electric vehicle (EV) charging and power solutions, raised $50m in Series C funding round. The company intends to use the funds to accelerate international market expansion of its flagship product, Boost Charger™, and expand production capacity. – FinSMEs

Volta Trucks Closes $20M Round – The London-based manufacturer of electric commercial vehicles, Volta Trucks has closed a $20-million convertible debt funding raise. Leading the raise was New York-based investment firm, Luxor Capital. – GreenCarCongress and Volta Trucks

Volta Charging Raises $125 Million – Advertising-based charging network Volta has raised $125 million in new funding in a process managed by Goldman Sachs. With the new financing, Volta has now raised over $200 million in funding and intends to use its cash to begin expanding internationally. – TechCrunch

Acquisitions

Shell to Acquire Ubitricity, UK Charging Network – Royal Dutch Shell announced on January 25 it was acquiring ubitricity, the owner of the UK’s largest public on-street electric vehicle charging network, for an undisclosed amount. The deal for the company that has over 2,700 on-street charge points in the country is expected to be completed late this year. – Reuters