While the Airbnb and DoorDash IPOs captured the business headlines last week, the continuing parade of electric vehicle-related SPACs being announced has generated significant attention and interest both within and outside the EV community.

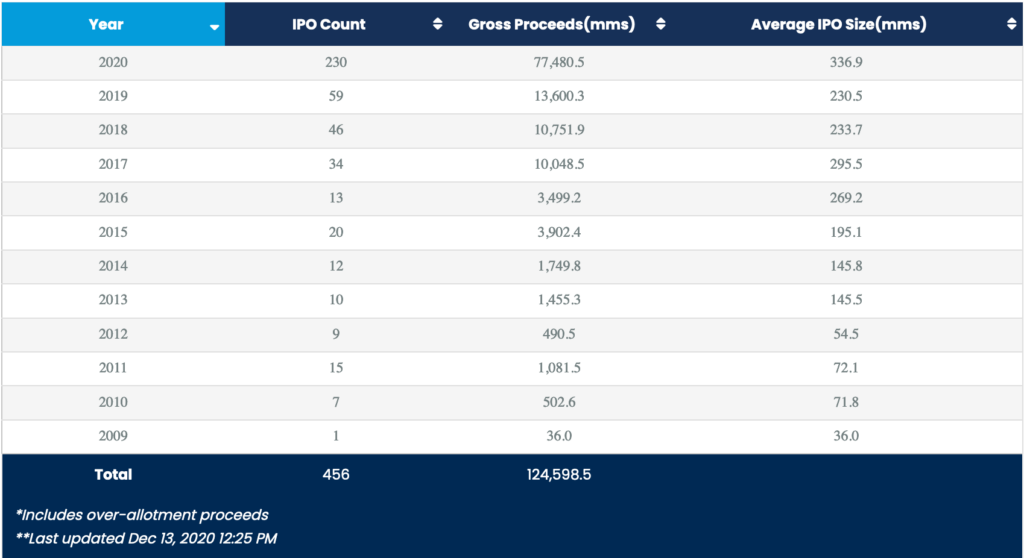

First, “SPAC” is the acronym for “special purpose acquisition company” (definition below). According to Investopedia, SPACs have become more common in recent years, with their IPO fundraising hitting a record $13.6 billion in 2019—more than four times the $3.2 billion ($3.4 billion according to SPACInsider.com) they raised in 2016.

A special purpose acquisition company (SPAC) is a company with no commercial operations that is formed strictly to raise capital through an initial public offering (IPO) for the purpose of acquiring an existing company. Also known as “blank check companies.” – Investopedia

Since 2009 there have been 456 SPAC IPOs in the US, but with 230 YTD, 50.4% have already occurred in 2020, according to SPACInsider.com. The $77.5 billion raised so far in 2020, is 5.7 times the amount raised in 2019.

By my count there are now 16 EV-ecosystem (this includes two autonomous vehicle technology) companies that are either already public via a SPAC or are in the process of completing the mergers. Most of them are expected to close by Q1 or Q2 of 2021. (The following table includes 27 public EV-related companies in total, including the 16 SPACs.)

Note: The above table includes just a few data points on each company. EVAdoption is in the process of building out a full database on these companies with ~18 data points. If you’d like to be notified when the database is updated and available to view, please subscribe to the EVAdoption newsletter (below or here).

To get a strong sense of why there is so much interest in the electric vehicle SPAC opportunity right now, listen to this interview with Barry Engle on the TheStreet.com. A former GM executive who left the Detroit auto company in July, Engle has formed a new SPAC, Qell Acquisition Corp (QELLU) “seeking to invest in a high-growth business in the next generation mobility, transportation or sustainable industrial technology sectors.”

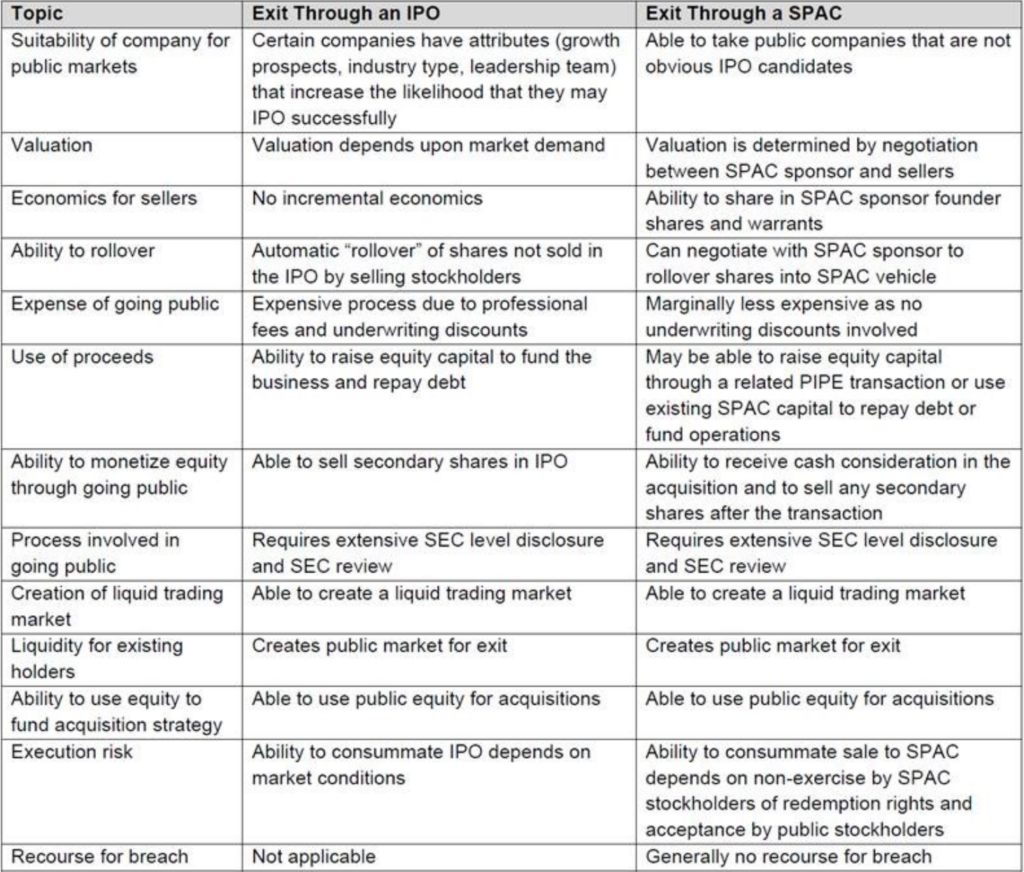

For a look at the differences between and advantages/disadvantages to taking a company public via a SPAC versus IPO, check out the table below from Global Private Equity Watch. The only thing I would add is my personal SPAC experience from 2005 when I worked for a marketing software company that was acquired by a SPAC.

In this case, we eventually rolled up 4 companies into the SPAC and the company never found its footing. There was some bad luck involved (Google bought a competitor of one of the acquired companies and offered the same product for free), but ultimately a key part of the company’s failure was due to the executives with the SPAC having zero expertise in our industry.

So my only two cents when assessing SPACs would be to (among many other factors) look closely at the backgrounds and expertise of the executives behind the SPAC. Are they simply opportunistic investors, or do they have deep experience and expertise in the industry and can provide parental guidance to the company they acquire?

Which EV Companies Are and Are Not Likely Candidates for SPAC Mergers?

Predicting which EV-related companies might (or might not) be future candidates for going public via a SPAC is a bit of a fool’s game as the current frothiness in the US stock market makes it very tempting for executive teams to go for the money now before the well dries up.

Most of the companies that have gone the SPAC route so far did not surprise me, except for ChargePoint. With more than $659 million raised prior to the SPAC, I would have expected the charging equipment and network company to wait and go pubic through an IPO. But since it doesn’t expect to be profitable until 2024 and according to the SPAC investor presentation, this merger would provide enough funds to fuel its operations until then.

The strength of the US stock market (despite the COVID-19 pandemic and its impact on several sectors), the continuing rise in Tesla’s share price (and upcoming inclusion in the S&P 500), and the constant stream of EV announcements and news coverage have suddenly brought a lot of attention to the space and money seeking out the “next Tesla.” There of course aren’t going to be many more Tesla-like companies emerge in the next few years, though the strongest candidates are likely solid upstart OEMs such as Rivian and Lucid Motors, and possibly a company like QuantumScape, the solid-state battery company.

Following is a brief look at several electric vehicle industry companies that could go public via a SPAC, spin-off, or regular IPO in the next few years. This list includes only US-based companies, but I’m sure there are many based outside of the US that will trade on US exchanges.

Potential SPAC candidates include:

- Aptera Motors – The 3-wheeler, solar-powered EV company recently showed off its Aptera Paradigm vehicle which appeared to be a logical means to showcase the company, which most of us had forgotten about, to potential SPAC investors.

- Bollinger Motors – Based on an interview in Yahoo Finance with Bollinger’s CEO, a SPAC looks very possible, but perhaps not until Q1 or Q2 of 2021.

So we’ve brought him one investor already. We’re closing another round this month. And we definitely have had a lot of SPAC interest, so we’ve talked to a number of them this year. And just to jump right into, is basically we thought it wasn’t quite the right time for us. We want to get some more of these strategic alliances set up and announced and kind of have the fuller picture. – Robert Bollinger, CEO Bollinger Motors – Yahoo Finance

- Fermata Energy – A V2G company with a particular focus on vehicle to building solutions, Nuvve, one of Fermata’s prime competitors/peers recently went the SPAC route so Fermata is certainly a possibility – though it may be too early at this stage.

- Proterra – The electric bus maker headquartered in Burlingame, CA (near SFO airport) seemed like an ideal candidate for a future IPO. But with former Proterra CEO Ryan Popple now a director of the newly formed Qell Acquisition Corp SPAC mentioned above, rumors are flying that Proterra is a prime candidate to merge with Qell.

- Redwood Materials – Founded by former Tesla CTO J.B. Straubel, Redwood Materials is looking to solve a huge future problem by recycling batteries, electronics, and end-of-life products. Redwood seems an ideal company to cash in on the SPAC craze right now.

- Solid Power – Colorado-based Solid Power is one of the leading companies developing solid-state battery solutions for electric vehicles. I’ve interviewed CEO Doug Campbell on two occasions, including for this CleanTechnica article in 2017 and have been impressed with the business-like, low-hype approach of this company. With Toyota and QuantumScape (which has gone public via a SPAC – symbol QS) grabbing the headlines around SSBs recently, I would be surprised if there isn’t a SPAC in the works with, or at least strong interest in, Solid Power.

- Volta Charging – San Francisco-based Volta is growing quickly and is looking to dominate its corner of the market which is selling ads to retailers and brands through its EV charging station out-of-office advertising network. (Read my profile of Volta Charging on CleanTechnica.) Volta has been building up its executive team in 2020, so I would not be shocked to see it merge with a SPAC in 2021.

- WiTricity – The wireless EV charging company has several strategic investors and in November closed a $34 million venture capital-based round, including from Mitsubishi. With this recent capital raise WiTricity may not need to raise more capital for awhile, but with very few competitors in the wireless charging space, a SPAC in 2021 might be to attractive to pass up.

- Xos – Based in North Hollywood, CA, Xos is part of an increasingly crowded field of legacy and start-up companies building medium and heavy duty commercial electric vehicles, including step vans, box trucks and semi-truck tractors. Nine start-ups in the delivery van or commercial truck market have either gone public or are in process of closing a SPAC merger, which suggests that Xos may be at a disadvantage if it doesn’t jump into the public markets soon.

Potential spin-offs into a SPAC or IPO may include:

- Electrify America – Formed out of the Volkswagen America dieselgate settlement with the US government, the fast-growing DC fast charging network could be spun out via either an IPO or SPAC. My guess is VW would wait until its charging investment commitments are completed, and then could take Electrify America public through an IPO – assuming a profitable business model is figured out by then.

- EVgo – The DC fast charging network was acquired in January 2016 by LS Power and so unless LS Power decides to spin off EVgo, they will likely remain private. However, LS Power may not be able to resist the current SPAC craze to raise additional growth capital for EVgo.

Companies unlikely to go the SPAC route and may instead take the more traditional IPO route, include:

- Chanje – The Southern California-based maker of electric delivery vans is facing a growing number of aggressive and well capitalized players in the delivery van market, including Ford, Mercedes-Benz, Rivian, Arrival, WorkHorse, GM, and many others. FDG, a Hong Kong-based electric vehicle and battery company, combined with others, have invested $1 billion into Chanje (pronounced “change”) to develop and jointly bring the Chanje vans to market. FDG may prefer to continue to be the majority owner of Chanje, or take it public via an IPO. But a SPAC in 2021 is certainly not out of the question.

- Lucid Motors – With a 67% ownership stake by the Public Investment Fund of Saudi Arabia, I wouldn’t expect the company to go the SPAC route. Rather the company will likely stick to its existing plans to do an IPO which CEO Peter Rawlinson mentioned during the global reveal of the Air back in September. I would guess we might see a Lucid IPO in 2022 after about one year of sales of the Air.

- Rivian – According to CrunchBase, Rivian has taken in $5.6 billion in funding to date, including $700 million from Amazon. Like Lucid, I think it is very unlikely they would go the SPAC route as the company would likely be one of the most anticipated IPOs in years. I expect the company to IPO perhaps in 2022 or late 2021 depending on the timing of production and delivery of its delivery van and R1T pickup.

What companies have I missed or do you think I’ve gotten completely wrong? Let me know in the comments below.

Disclosure: I have just recently purchased a small number of shares in several of the public companies mentioned above – ranging from a single share in TSLA to 50 shares in GIK.

Announcing the acquisition of EVAdoption by Paren →

Announcing the acquisition of EVAdoption by Paren →

14 Responses

Fantastic overview of SPACs and the hottest EV companies. Thanks for posting!

One point I’m not clear on is the “difference” in funding amounts and flexibility between a SPAC and an IPO.

An example would be Lordstown Motors getting $600M more or less from their SPAC. A car company needs a lot more than $600M to develop and introduce a new pickup truck in the United States. Look at Rivian and how far they have to go still before being a competitive brand in the US.

Rivian, of course, as you stated will go IPO.

My thought is that these SPAC’s don’t represent that much capital to these new EV manufacturers who *don’t have the capital to develop sales and service networks on top of the vehicle.

I think that Tesla has become more aware of their competitive disadvantage when they wake up one morning and there are 70 EV models in the EU and soon, 40 models in the US that all have established sales and service networks. There are a combined 8,000 Ford, Dodge and GM truck dealers in the US that take trade ins, market, inventory and repair/service their products.

My point is that these SPAC’s seem small and don’t offer the scale of an actual IPO whilst subjecting the new, small, unprofitable company to the expense and pain of reporting a long line of quarterly losses.

If I was one of these company’s CEO’s I would assuredly take the SPAC. It is “quick money” and far far easier than going IPO. I just wonder how it will work out in the long run. I think one new model on the US market might cost $4B to get on the market and that means they need more the day after that.

I thank you for all of this work! It is both important to the adoption discussion and to those looking at investing in these companies. The media pumps everything up, but, is the first bemoan the difficulties of a public company.