While the growth in deliveries of the Tesla Model 3 is grabbing all the headlines, there are 41 other EV‘s available in the US – a few of which are showing some less obvious, yet still interesting sales trends.

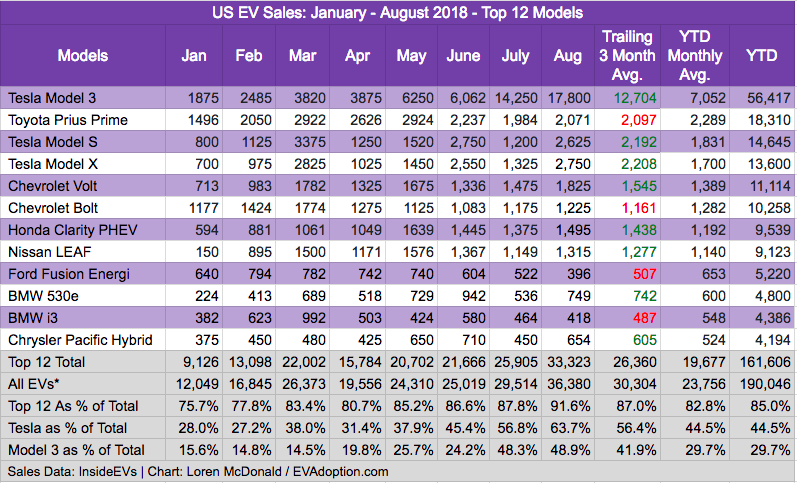

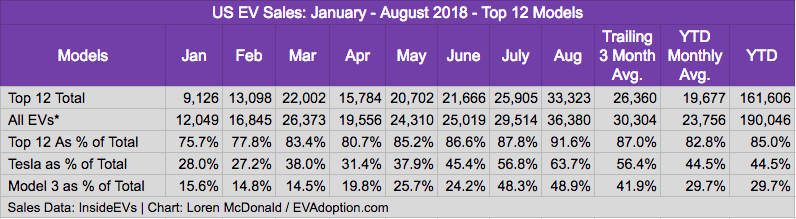

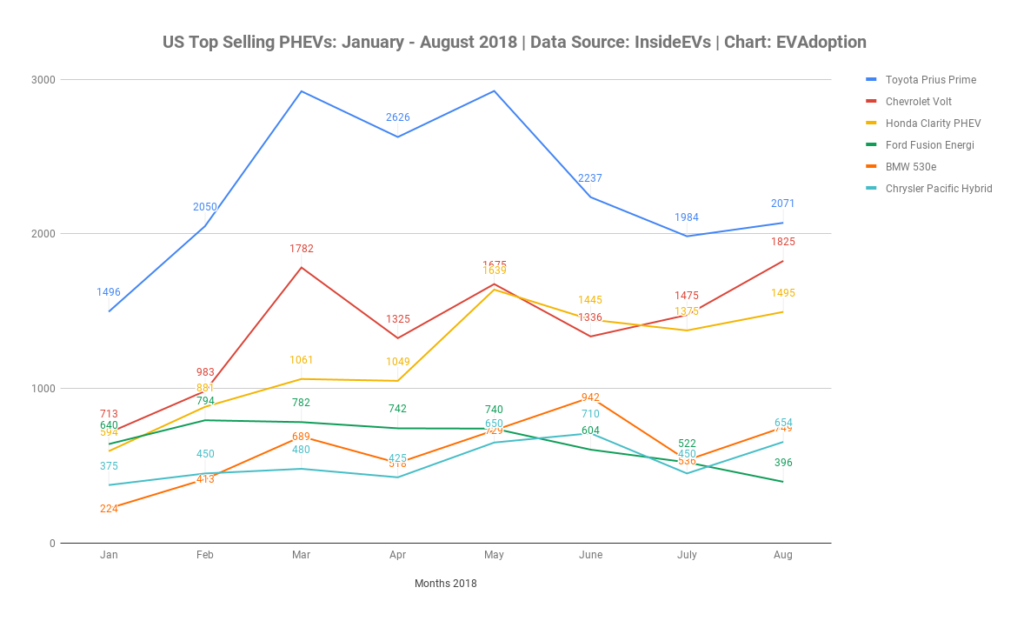

Last month I focused analysis on the top 10 EVs in the US, but this month and likely for the foreseeable future I will expand the list to the top 12. This is because the BMW 530e and i3 and Chrysler Pacifica Hybrid (PHEV) are all within a few hundred units of each other for the year and in any given month might swap places in and out of the top 10. Additionally, the perennial top-10 selling Ford Fusion Energi could fall out of the top 10 by the end of 2018.

Following are 10 key trends from August and YTD 2018:

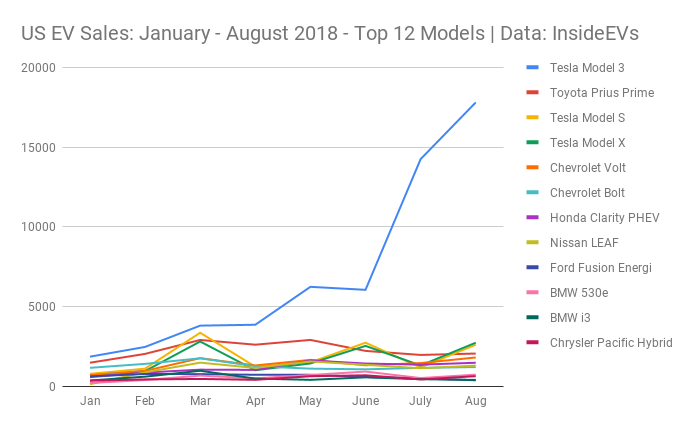

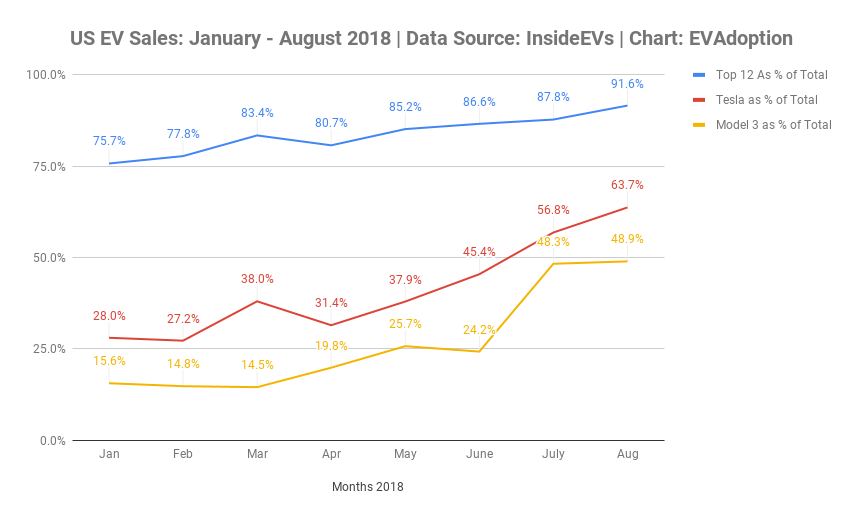

1. Tesla Model 3 deliveries are through the roof: With estimated sales of 17,800 for the month of August according to InsideEVs, the Model 3 is simply in unchartered territory. At that volume of sales, the Model 3 ranks in the top 25 selling cars and light trucks in the US – a first for an electric vehicle. Additionally, the Model 3 accounted for an estimated 48.9% of ALL EV sales in the US in August. YTD, the Model 3 has sold an estimated 29.7% of all EVs in the US.

While it is tough to predict future sales of the Model 3 as there are many moving pieces of the puzzle, I anticipate sales to be in the 12,000-15,000 units per month level for the next few months. Then once production starts to shift for international deliveries, we could see the US sales of the Model 3 drop below 10,000 per month until the point in 2019 when deliveries of the short-range version begin. At that point, sales could climb back up into record-breaking levels.

2. Tesla and top 12 EV models dominate share of total EVs. The 80/20 rule has long been prevalent with the top selling EVs, but with strong sales of the Model 3, the top selling EVs are simply crushing the rest of the pack. In August, the top 12 EVs comprised 91.6% of all EV sales, and 85% YTD. Tesla accounted for an estimated 63.7% for August and 44.5% YTD.

3. Honda Clarity PHEV is showing no signs of declining demand: I continue to be impressed by the consistent strong sales of Honda’s PHEV version of its multi-powertrain Clarity model. Part of the reason may be the overall popularity of Hondas in California and according to a friend in Southern California, Honda is leasing the car at very attractive rates. Subject to new competitive entrants and a change in pricing strategy by Honda, the Clarity PHEV should remain a solid-selling PHEV in the 1,200-1,500 units per month range.

4. BMW 530e quietly climbs the ranks of top selling EVs. Sales of the 530e, BMW’s PHEV version of its popular 5 series sedan, have been steadily climbing the InsideEVs sales ranks over the last year. In August, the 530e accounted for an estimated 21.8% of total 5 Series sales in the US.

At its current rate of sales and the continuing decline of the Ford Fusion Energi, the 530e will likely move past the Energi PHEV in October or November to become the 9th highest selling EV in the US.

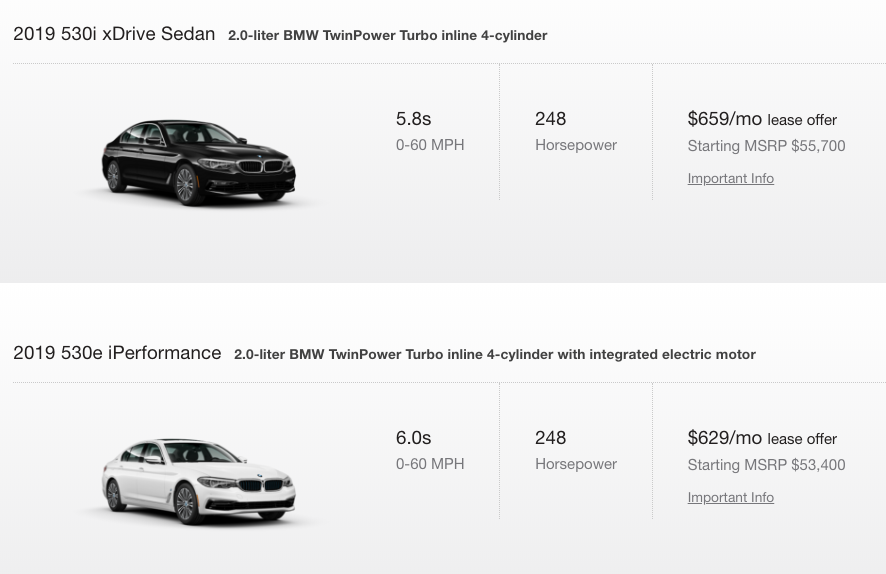

I believe there are 5 primary reasons the 530e is selling so well:

- Little to no price differential from the ICE versions of the 5 Series. Looking on the BMW site, the 530e lease price is the same or less than other 5 Series models.

- Available US Federal electric vehicle tax credit of $4,668.

- Early adopting higher income buyers are a good match with the luxury/performance value proposition and BMW brand heritage.

- BMW’s popularity in early adopting EV markets such as the Bay Area and Los Angeles contributed as well.

- While the all electric range of 16 miles (as rated by the EPA) is disappointing, with access to high-occupancy lanes in some states, combined with the tax and utility credits – 5 Series buyers have little downside to opt for the 530e.

5. Toyota Prius Prime sales have likely peaked. The Prime has been one of the hottest selling EVs in the last year, jumping into second place on the sales list and nearly reaching 3,000 units sold in both March and May of 2018. But in the last 3 months, the trailing average has declined to less than 2,100 units suggesting competition from the Clarity in particular may be stealing significant share from the Prime.

While the Clarity has a starting MSRP of around $6,000 higher than the Prime, many Honda dealers are apparently offering aggressive lease rates that make the Clarity – with almost double (47 miles) the range of the Prime (25 miles) – a better option for many buyers.

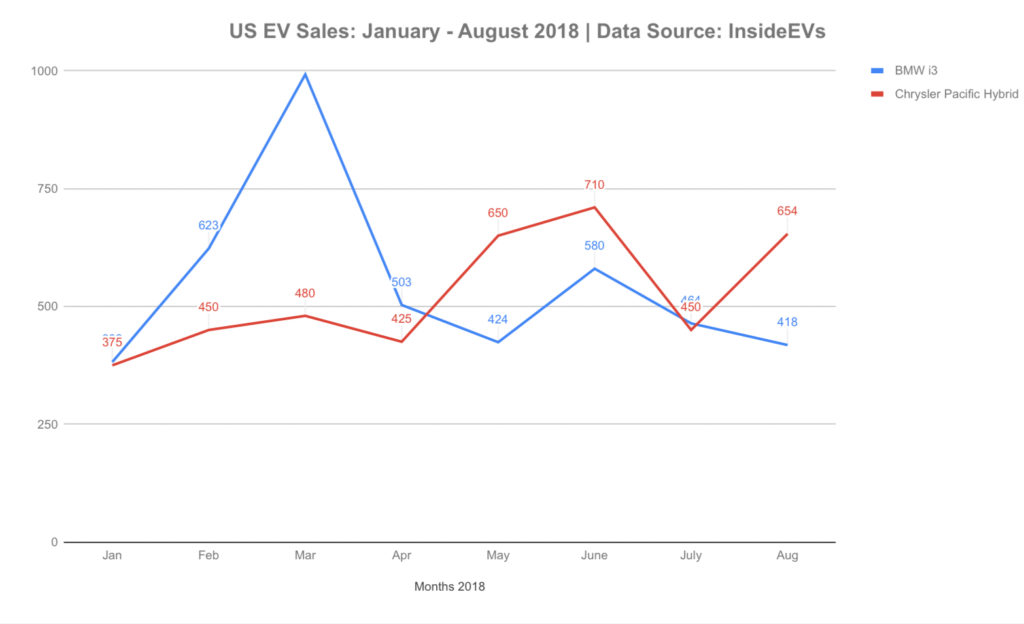

6. Ford Fusion Energi and BMW i3 are headed toward insignificance. While appealing to different buyers and one being a PHEV and the other a BEV, both the Ford Fusion Energi and BMW i3 are simply headed towards irrelevance in the EV market.

The Fusion Energi’s decline is perhaps partly attributed to an overall decline in all Fusion model sales of -21% YTD and -35% YOY for August, but it is likely also losing sales to the Prius Prime, Volt and other EVs.

The BMW i3 is simply too expensive for a BEV with only 114 miles of range (although the extended range version has up to 180 miles) and there are now too many lower-priced EVs available, or significantly better performing, albeit higher-priced models like the Tesla Model 3. (Note: I’ve reached out to BMW’s EV PR team hoping for comments on the company’s plans for the i3, but my assumption is they will no longer invest in the i3 and instead will let it fade while all investment is going into the future BEV models iX3, iNext and iX4.)

7. Chevrolet Volt is rebounding – but for how long? Sales of the Volt remain strong and it continues to easily outsell its sister EV the Chevrolet Bolt, but it has clearly – and for the foreseeable future – lost the PHEV sales crown to the Toyota Prius Prime.

With more than double the all-electric range than the Prius Prime, you might expect the Volt to sell better than the Prime but clearly the $7,000 higher price and Toyota’s better brand image in markets like California have put a cap on Volt sales. When new BEV models from Kia and Hyundai become available in the US, Volt sales could take a pretty big hit.

8. Tesla Models S and X still selling well. While many predicted the Model 3 would crush sales of both S and X, at least to date this is not happening. While the Model X will soon face stiff competition from the Jaguar i-Pace and Audi eTron, for now the Model X is the only luxury SUV/CUV BEV on the market. Additionally, the Model 3 being a mid-sized sedan will not meet the needs of buyers truly looking for a crossover.

Sales of the Model 3 will likely start to impact Model S sales, but the Model S has its larger interior and liftback versus traditional trunk in the Model 3 – providing some clear differentiation between the models. This will, however, clearly be a trend to watch in the coming months.

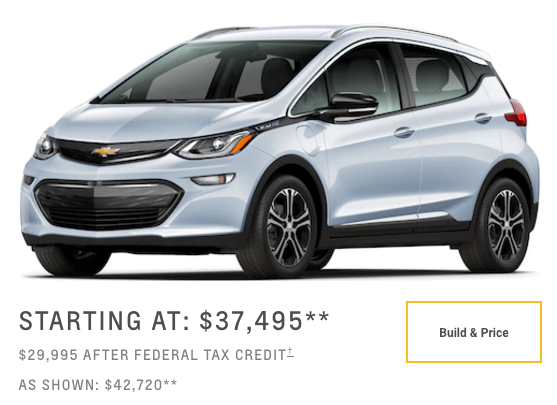

9. Chevrolet Bolt sales continue on a slight downward average. Sales of the Bolt are on a slight decline and by year end, the Honda Clarity PHEV could overtake the much vaunted BEV from GM. There are probably several factors contributing to the Bolt’s decline including supply issues, the launch of the updated Nissan LEAF, the growing popularity of the Honda Clarity PHEV and of course the availability of the Tesla Model 3. Once GM increases supply of Bolts, it will be interesting to see what, if anything, they do from a feature and pricing/financing perspective to bump up sales.

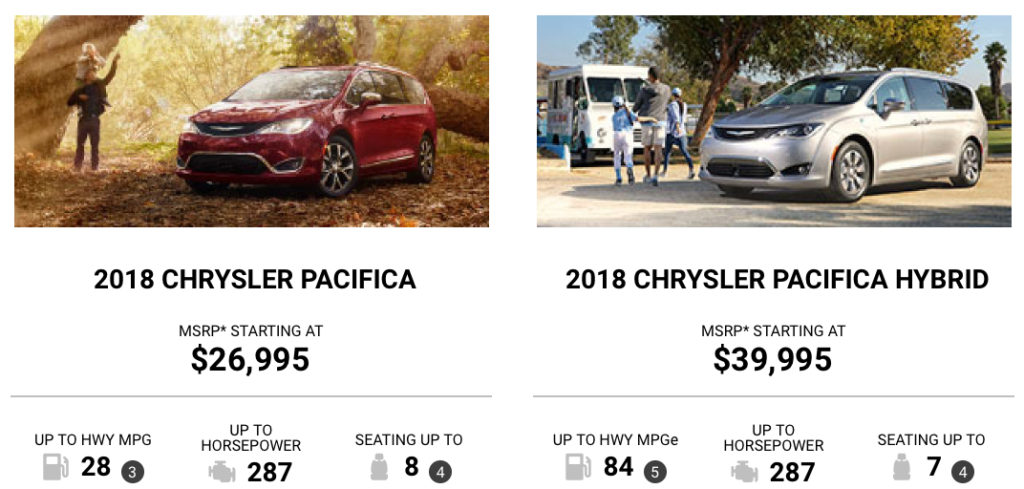

10. Chrysler Pacifica Hybrid is selling well, but growth is likely capped. Chrysler’s Pacifica Hybrid PHEV has been well received in the market and sales continue to climb gradually, but its $13,000 price differential over it the regular Pacifica will cap sales below 10% of overall Pacifica sales. In August, the Hybrid PHEV version accounted for a respectable 7.1% of total Pacifica sales, but is well short of the BMW 530e’s estimated nearly 22% of 5 Series sales.

The Pacifica has no direct competition, so families looking for a minivan with higher than average mileage have only one choice. Federal, state and utility incentives help close the price gap with the regular Pacifica version, but with room for one less passenger and the much higher MSRP, look for the Pacifica Hybrid to remain a strong seller, but not make any significant move up.

Announcing the acquisition of EVAdoption by Paren →

Announcing the acquisition of EVAdoption by Paren →