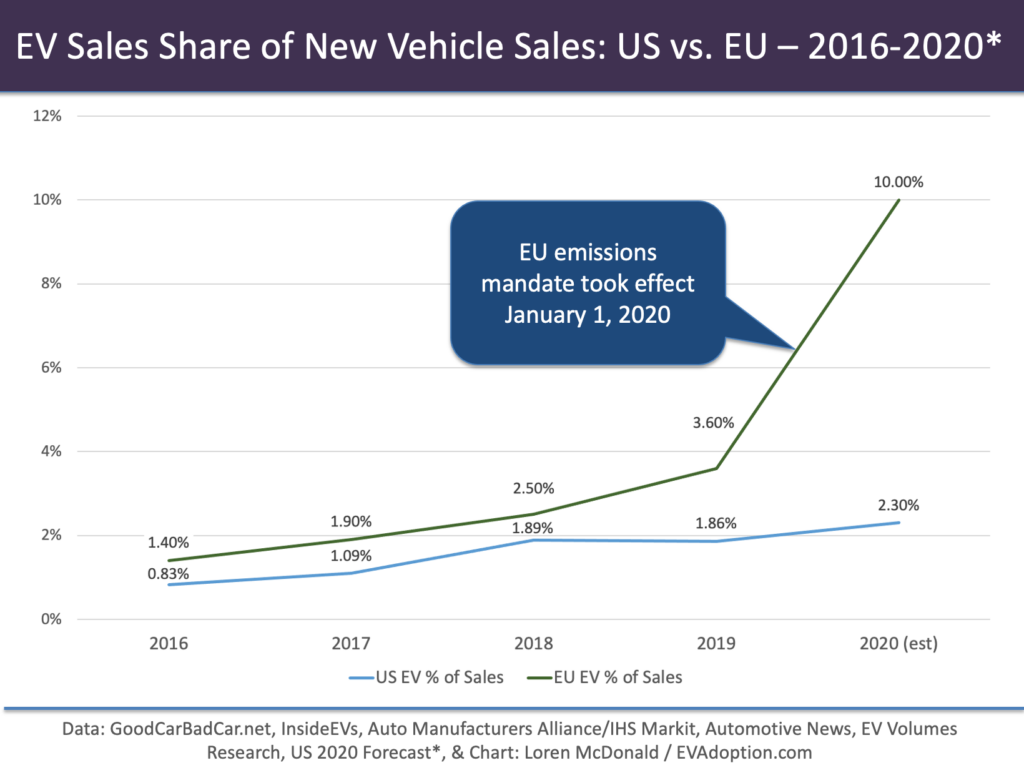

In the US, electric vehicle growth is a market share play.

Because light passenger vehicle sales are basically flat and not expected to grow in the coming years, to increase the share of EV sales OEMs need to convince new car buyers to consider an EV over a gas, diesel or regular hybrid.

In the European market right now EV sales are increasing substantially in most countries due to automakers finally supplying an array of EV models and in high volume to minimize or eliminate huge EU emissions fines. As a result, while new EV sales are now capturing more than 10% market share in Europe, the US plods along at under 3%.

But the commercial electric delivery van market is poised to be very different for at least four reasons:

- Ecommerce growth

- Fleet owners focus on total cost of ownership

- Corporate sustainability goals

- Purpose-built vehicles

Ecommerce Took A Huge Leap in 2020

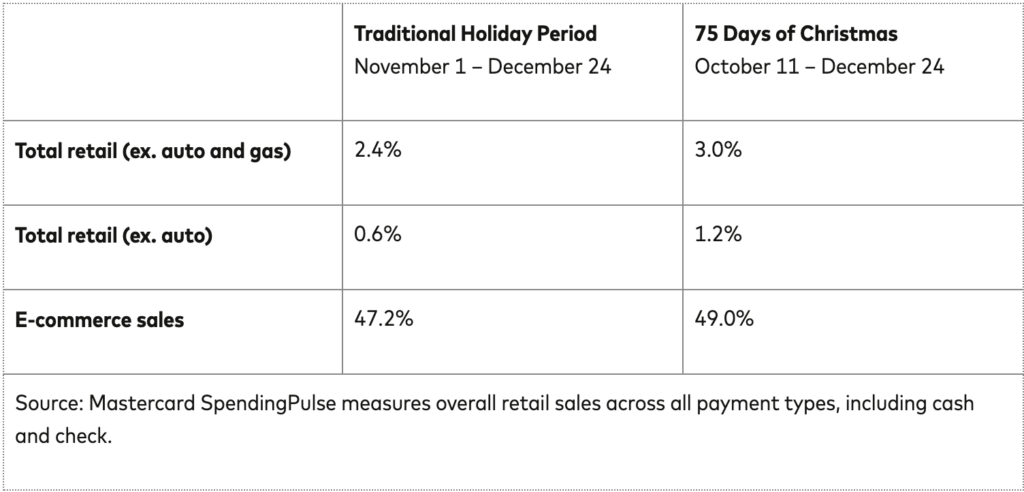

The 2020 holiday ecommerce season was the biggest ever in the US, with online sales accounting for 19.7% of overall retail sales, a 47% jump from 13.4% in 2019, according to Mastercard SpendingPulse.

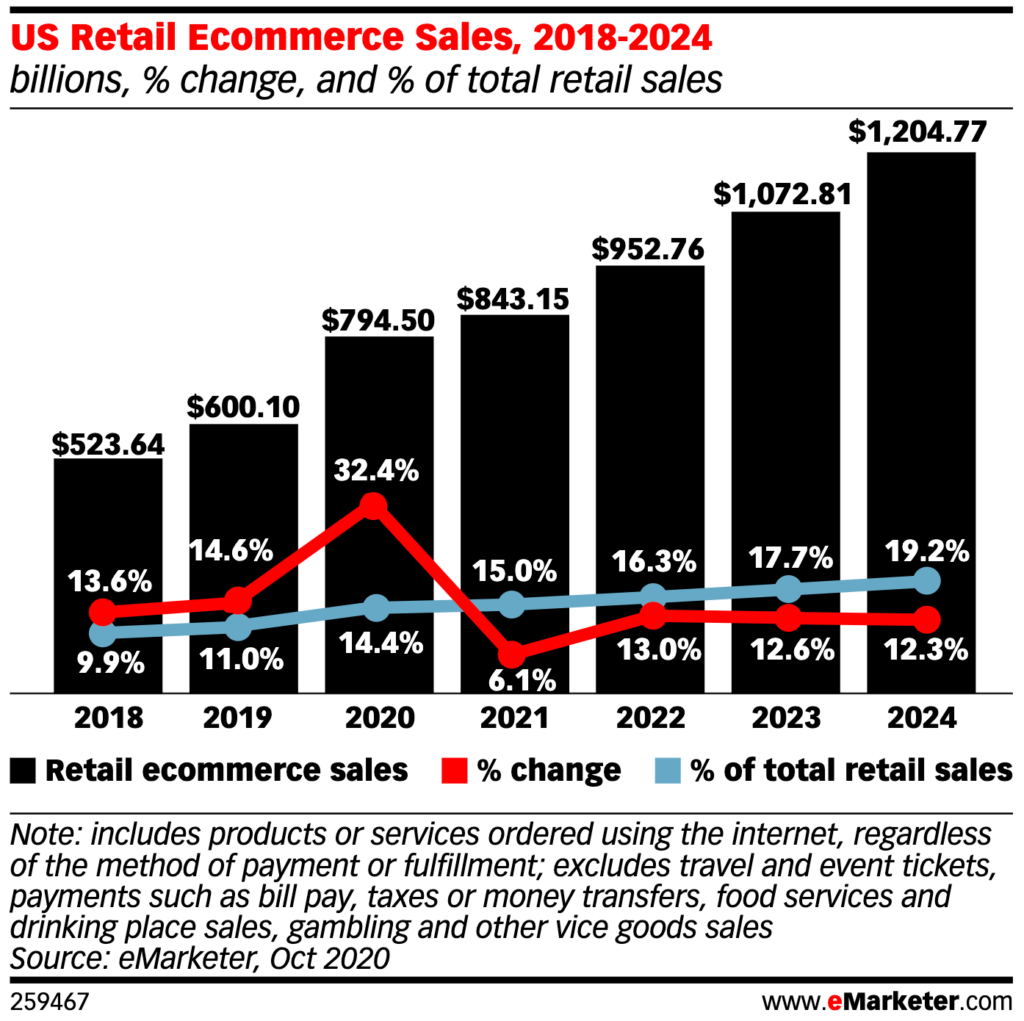

And while much of the 2020 increase was due to shelter-in-place orders, eMarketer forecasts that US ecommerce sales will increase another 50% by 2024. And by then, 1 in 5 retail purchases will be online.

But the huge increase in online purchases can wreak havoc with shipping carriers (FedEx, UPS, USPS, Amazon, etc.) which in 2020 could not keep up with demand resulting in many gifts not arriving in time for the holidays. The shipping carriers simply didn’t have enough capacity – having a shortage of sorting workers, trucks and delivery vans, and drivers.

Increased Demand for Delivery Vans

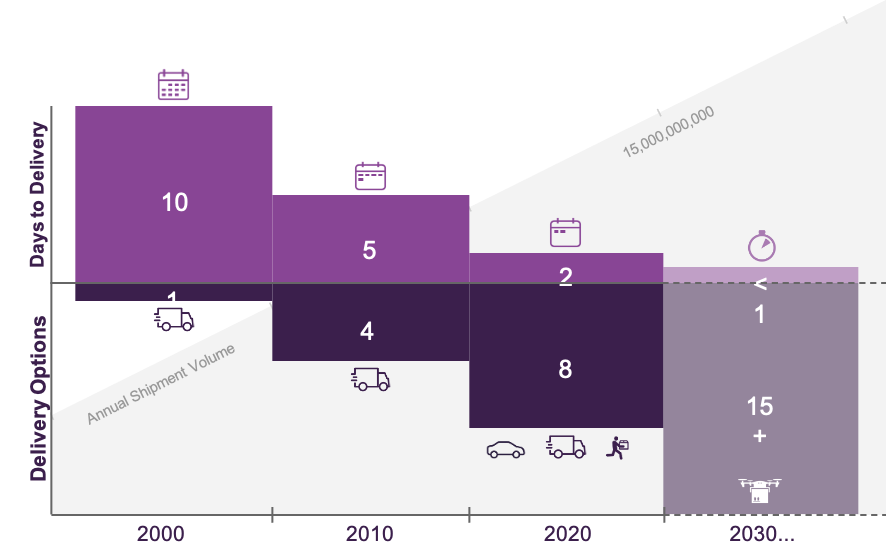

On top of the continuing growth in online sales, consumers’ shipping options and expectations are changing rapidly as well. In 2000, if you ordered from an online retailer you had an average of a single shipping option that would take 10 days for delivery, according to Convey, a Delivery Experience Management company that works with retailers and the shipping carriers. Fast forward to 2020 and you had an average of 8 shipping options that took an average of 2 days for delivery.

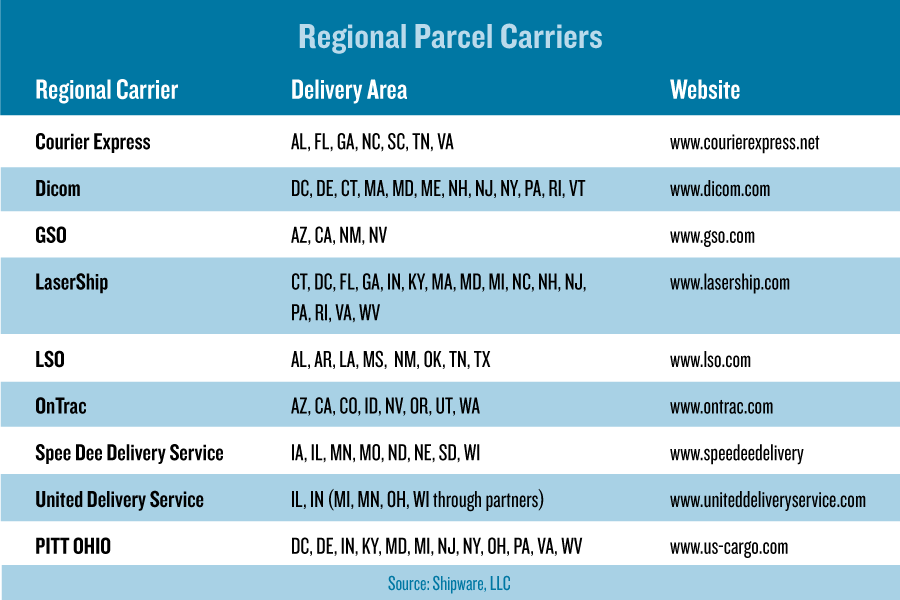

What these trends have all led to is a relatively sudden increased demand for commercial vans to deliver an ever growing number of packages. And the demand for vans is not just coming from the major players such as FedEx, UPS, USPS, DHL, Amazon, and Walmart – but close to 50 additional national and regional deliver carriers.

2020 saw a number of factors lead to a shortage of delivery vans. This included the pandemic closing down vehicle assembly factories and at the same time the shelter-in-place restrictions led to a huge increase in online orders during the already busy holiday ecommerce shopping season.

“If there’s a cargo van out there, we’re trying to buy it,” Brendan Keegan, CEO of vehicle provider Merchants Fleet, told Bloomberg. His company reportedly expects to have 15,000 vans out for lease at the end of the year, more than double the 6,000 it had last year.

New York Post, November 25, 2020

~30 New Electric Delivery Vans Coming to North America and Europe

Beyond the growth in ecommerce, achieving corporate sustainability goals and reducing operating costs (total ownership costs – TCO) are also key reasons the shipping and last-mile delivery carriers are looking to ramp up purchases of electric delivery vans. By my analysis there are roughly 30 new electric delivery vans that will reach market in North America and Europe in the next 2 years.

The above factors – along with many new vans being purpose built for or in partnership with fleet customers like FedEx, UPS, and USPS – could drive the delivery van vehicle category to become the first transportation segment to reach near 100% market share of electric vehicles.

What’s Driving the Supply Side?

On the supply side, there are at least four interesting aspects to what’s driving OEMs to move more quickly to produce electric delivery vans than light passenger vehicles:

1. Van “Conversions”: Because of the fundamental configuration of delivery vans, several OEMs – especially the European brands – moved quickly to simply replace the internal combustion engine and traditional drivetrains with relatively smallish battery packs and electric powertrains.

Makers such as Volkswagen, Mercedes, Citroen/Peugeot/Vauxhall and Fiat have taken their existing diesel vans and converted them to electric drive – a relatively easy job within the large, flat expanse of metal found in the back of most vans. But there are newcomers to the class as well. – AutoExpress-UK

2. Fleet Orders: Most of the legacy automakers have been a bit slow to embrace electric passenger vehicles due to factors including higher vehicle price, cost of batteries, consumer range anxiety, lack of charging infrastructure and slow charging speed compared to gas station refueling. But electric delivery vans are an ideal fit with fleet buyers because of factors including:

- Known daily range requirements – 75 miles is the average daily trip in the US according to Ford’s analysis of its existing Transit customers. Unlike passenger vehicles, where most US consumers want at least 300 miles of range – fleet delivery van buyers can get buy with around 125-150 miles of range for most of their van’s daily delivery routes. This allows the OEMs to use smaller battery packs and reduce overall cost and weight of the vans.

- Ability to charge overnight: When vans return to the fleet yards in the evening, they can easily reach a full charge by the morning with Level 2 charging equipment – negating the need for more costly DC fast charging infrastructure. And unlike longer-haul trucks, fleet manages don’t need to worry about charging delivery vans out it in the field.

- Lower TCO: Unlike most consumers, fleet owners care more about the total cost of ownership (TCO) – the cost to operate and maintain a vehicle over its life – than initial purchase cost. With EVs requiring less maintenance, having very little down time, and lower “fuel costs” – they are a perfect match for the goals and needs of fleet buyers.

- Sustainability: Companies such as Amazon, Walmart, UPS, FedEx, and others are under increased scrutiny to reduce their carbon footprint and achieve certain sustainability goals. For those companies where the movement of goods is a significant part of their business, it is a no-brainer for most fleet buyers to transition to fleets of electric delivery vans with zero tailpipe emissions and the added benefit of a lower TCO.

- Purpose-built vans: Legacy OEMs are developing new or redesigned electric vans and startups like Rivian, Workhorse, Arrival and others are in many cases designing vans from the ground up for specific customers such as UPS, FedEx, and Amazon. For fleet buyers such as the shipping carriers, being able to have input on the design of these new electric vans makes them even more attractive than existing ICE-powered vans.

Scott Phillippi, UPS senior director of fleet maintenance and engineering, said the package delivery firm believes electric vans have the potential to disrupt the commercial market.

“It’s going to be similar to what the Model 3 has done for the consumer market,” Phillippi said, referring to Tesla’s small near-luxury electric sedan. “Now all of a sudden, we’re off to the races.”

Reuters, June 4, 2020

3. Capital + Startups: Rivian has grabbed most of the headlines from both the amount of capital it has raised ($8 billion since 2019) and its order from Amazon for 100,000 delivery vans. But there are several other new entrants including Workhorse, Xos Trucks, Chanje, Arrival, Bollinger, and others with various levels of funding and huge plans to produce commercial vans.

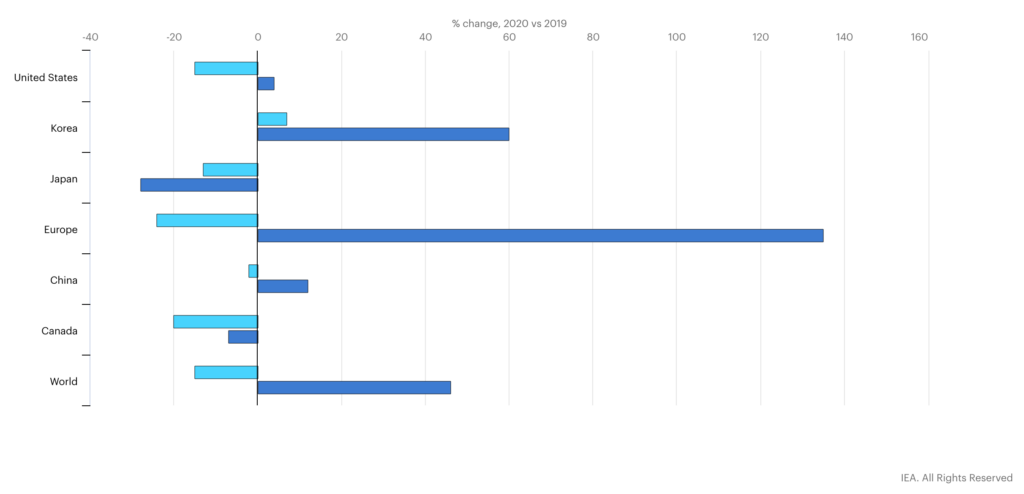

4. Growth Market: Except for China, most major markets will likely see flat to modest growth in light passenger vehicles. According to a report from Infiniti Research Limited, the global electric delivery van market is poised to grow at a CAGR of 25% for the period 2020-2024.

In February, Ford said it would introduce an electric version of its Transit van for model year 2022. “The most critical bet we will be making over the next several years will be our commercial vehicles,” Ford’s chief operating officer, Jim Farley, told Reuters at the time. – Reuters, June 2020

Arrival, the UK-based startup that will produce electric delivery vans and buses says “the forecasted market for vans and buses totals $430B by 2025.” (They don’t break the forecast out for just vans, but it is presumable a large chunk of the $430 billion.)

The market opportunity in the US and globally for electric delivery vans is huge, but the most exciting aspect is how perfect these vans are for shipping carrier fleet buyers. And the continuing growth of ecommerce is adding to this perfect storm. The questions now are:

- How quickly can OEMs scale up production of these vans or will they have battery supply issues?

- And how rapidly will fleet buyers transition to purchasing near 100% electric vans?

Buckle up, the electric commercial van market is going to be fascinating to watch and see if the OEMs can actually deliver quickly enough on the opportunity.

Announcing the acquisition of EVAdoption by Paren →

Announcing the acquisition of EVAdoption by Paren →