One of the most frequent questions you see these days in electric vehicle forums, blog comments and Facebook groups is some variation of the following:

$7,500 Federal tax credit when my car becomes available?

There are several variables that go into answering this question, including:

- The date you placed your reservation for a Tesla Model 3 greatly determines the order you will be in the queue once Model 3s start rolling off the assembly line. Tesla has an estimated 400,000 reservations, which they began taking on March 31, 2016. If you put down a reservation on that first day versus say a few months later, you might actually be looking at delivery of 6-12 months after those early reservation holders. Later reservations may translate into the tax credit being phased down in amount or phased out entirely.

- Tesla and SpaceX employees and current Tesla owners are said to have first priority for confirming their order. And Tesla reportedly will deliver vehicles first to purchasers in the Western US (near the Fremont, CA factory). But we likely won’t know for certain the order of vehicle production for reservation holders until we get close to Model 3s actually starting to be built.

- And then of course is the number of vehicles (Model S, X and 3) Tesla sells in 2017 and possibly early 2018 that brings the company’s total historical sales to 200,000 (more on this later).

- You must purchase, not lease the vehicle to be directly eligible for the tax credit. If the vehicle is leased, only the lessor and not the lessee, is entitled to the credit. However, the leasing company should pass on the federal credit to the lessor in the form of lower monthly lease payments.

- And of course, no one knows if the US Congress will decide to make changes to the tax credit, such as ending it completely, reducing the amounts of the credit or changing the timing and levels of the phase out of the credit.

How The Federal Tax Credit Works

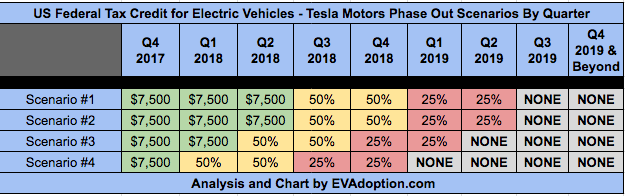

The federal tax credit is phased out over time beginning the second quarter AFTER the quarter in which a manufacturer reaches a total of 200,000 BEV or PHEV vehicles sold since 2010. Here is how the phase out works:

- The full amount of the EV qualifying tax credit is in place DURING the entire calendar quarter in which 200,000 EVs are sold by a manufacturer, AND through the subsequent quarter.

- Then the tax credit amount is reduced by 50%($3,750 for Tesla models) for the next 2 quarters.

- The credit is reduced again to 25% ($1,875 for Tesla models) of the original amount for the subsequent 2 quarters.

- At that point the credit expires completely.

So What’s The Big Deal?

So why is the question of availability of the federal tax credit such a hot topic? One reason is simply the perceived impact the credit might have on someone making a purchase decision on a Model 3 at around $40,000 versus a buyer of a $75,000 to $100,000+ Model S or Model X.

While I’m not aware of any data or surveys to support this, the theory is that some potential Model 3 buyers may change their mind if the tax credit expires (at the full $7,500 or one of the reduced levels) before their turn comes up to make the purchase.

4 Possible Scenarios to Predict the End of the Federal EV Tax Credit for Tesla Buyers

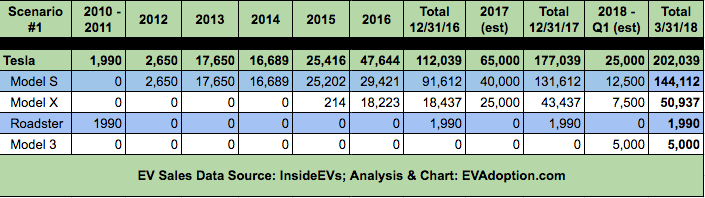

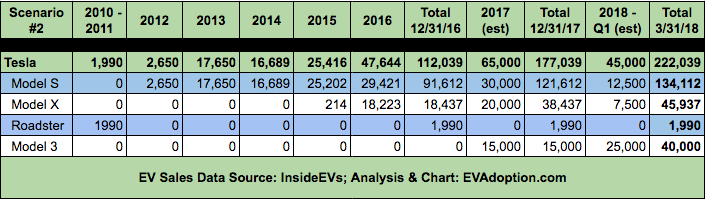

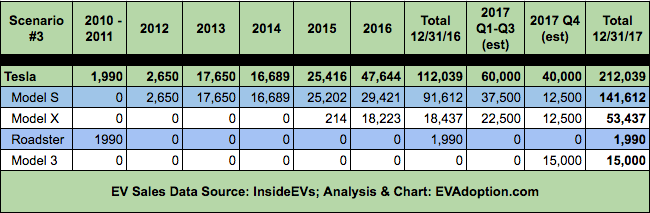

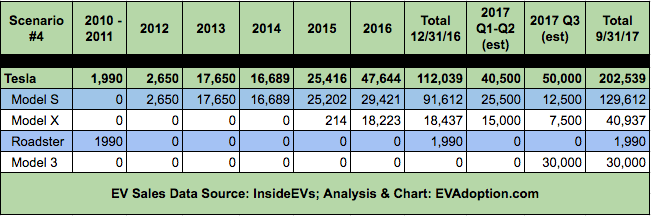

Since no one knows how many cars Tesla will sell in the US in 2017 or when the Model 3 will begin production at scale, I’ve created 4 sample scenarios showing combinations of sales for the Models S, X and 3.

While readers can argue with my assumptions and come up with another dozen variations, I’ve structured the scenarios so that regardless of the individual model sales numbers, Tesla would reach the 200,000 units sold milestone in 3 different and consecutive quarters, beginning in Q3 of 2017.

Production Delay Theories Debunked

I’ve read a variety of theories that suggest Tesla would delay production of the Model 3 (or perhaps the S and/or X as well) or shift production to non-US orders as a means to delay the phase out of the tax credit so more US buyers can take advantage of it.

While this is certainly a possibility, I think Tesla taking this approach is extremely unlikely for a few reasons:

- The 200,000-unit milestone is considered to be in the specific calendar quarter it happens, not the exact date. So unless, the 200,000-unit number was likely to happen in the last week or so of a quarter, it would mean delaying many thousands of cars from being delivered for several weeks to new owners. Tesla would receive a firestorm of negative press and social media attention if people got wind of this approach.

- If Tesla did delay delivery of orders, it just pushes out 3 months the start of the 5 quarters of availability after the quarter in which the milestone is reached.

- And even if Tesla leadership thought it was a good idea to delay reaching the milestone, it ignores that Tesla is a publicly-traded company and under intense scrutiny by Wall Street and shareholders to meet both unit and revenue targets. And the reality of delaying production would simply mean that perhaps 25,000 buyers would lose out on the $1,875 (25% of the $7,500) that would have been available for one later quarter. I doubt that would be worth disappointing analysts and investors.

Tax Credit Phase Out

- Edmunds – Electric Vehicle Tax Credits: What You Need to Know

- IRS Form 8936 (Form required to file with your tax return)

Announcing the acquisition of EVAdoption by Paren →

Announcing the acquisition of EVAdoption by Paren →