Proposed Changes to Federal EV Tax Credit – Part 2: End of the Manufacturer Sales Phaseout

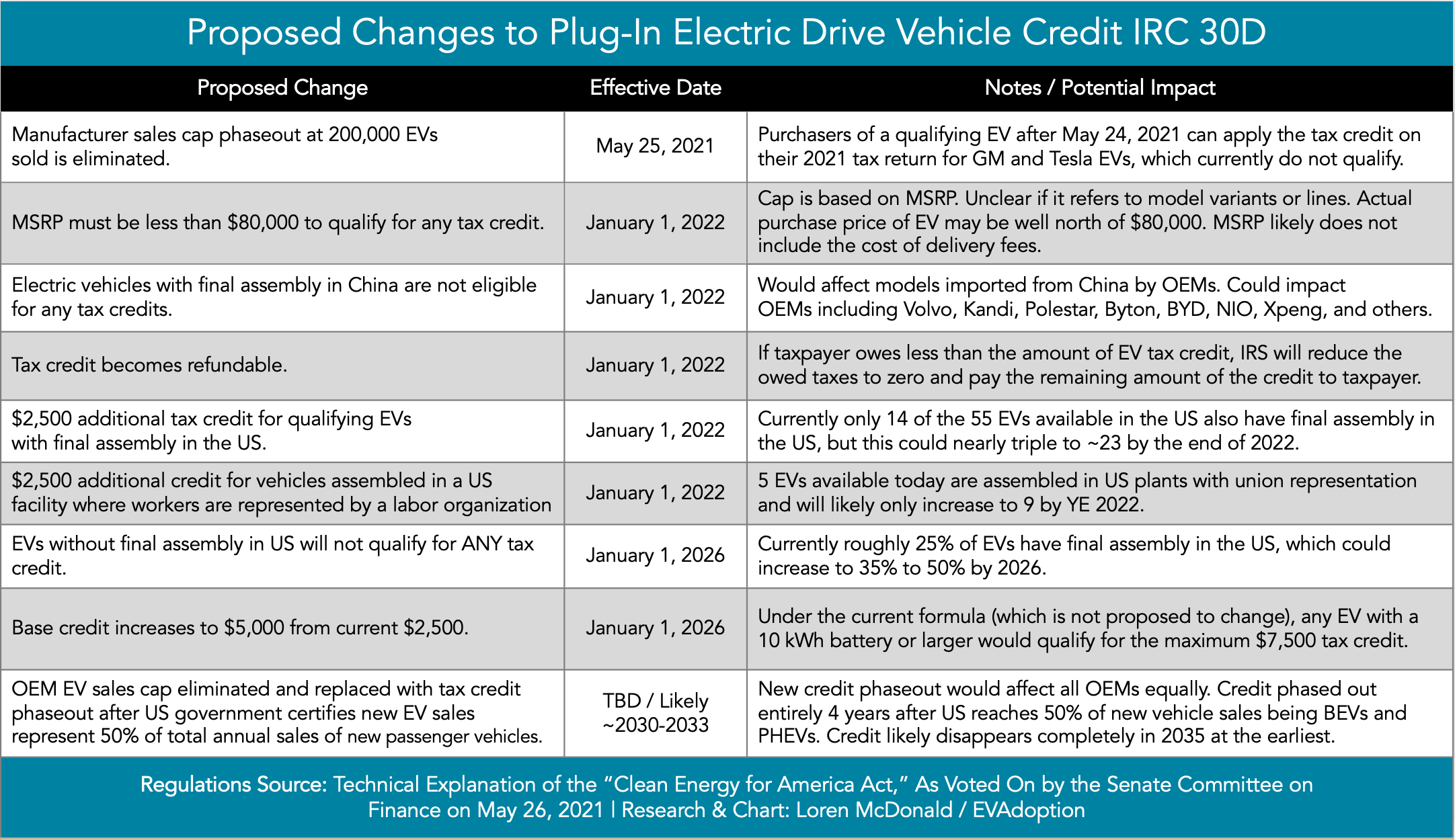

Arguably the biggest flaw in the Plug-In Electric Drive Vehicle Credit (IRC 30D) regulations is the triggering of a phaseout schedule of the tax credit when a manufacturer sells 200,000 total EVs (BEV and PHEV). In the Clean Energy Act for America (CEAA) proposed legislation, this per manufacturer threshold would be eliminated and replaced with an industry-wide phaseout based on reaching 50% EV sales share.

Announcing the acquisition of EVAdoption by Paren →

Announcing the acquisition of EVAdoption by Paren →