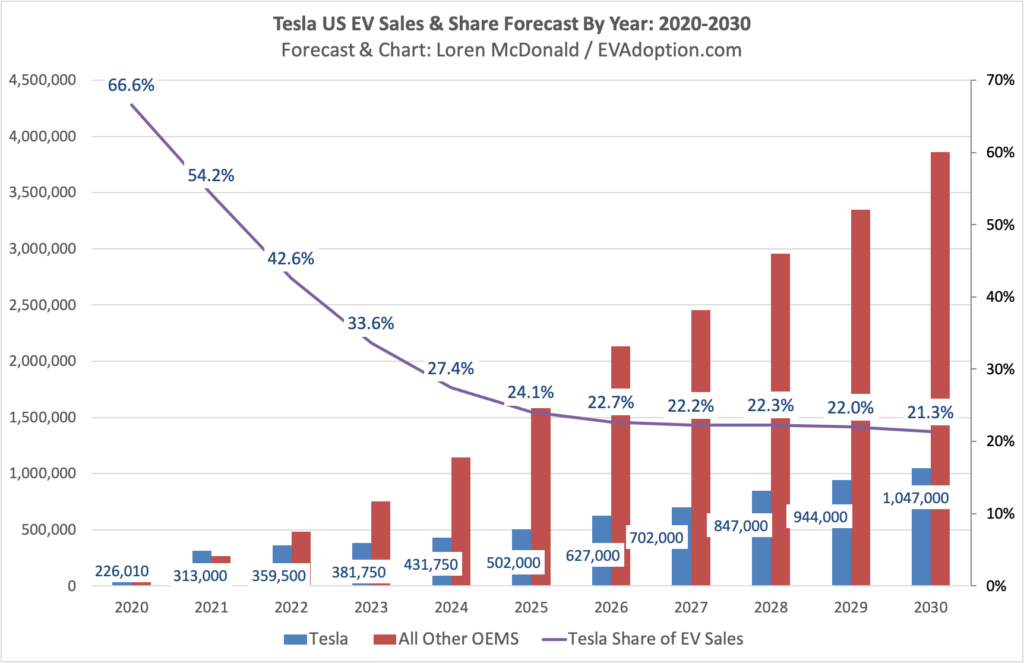

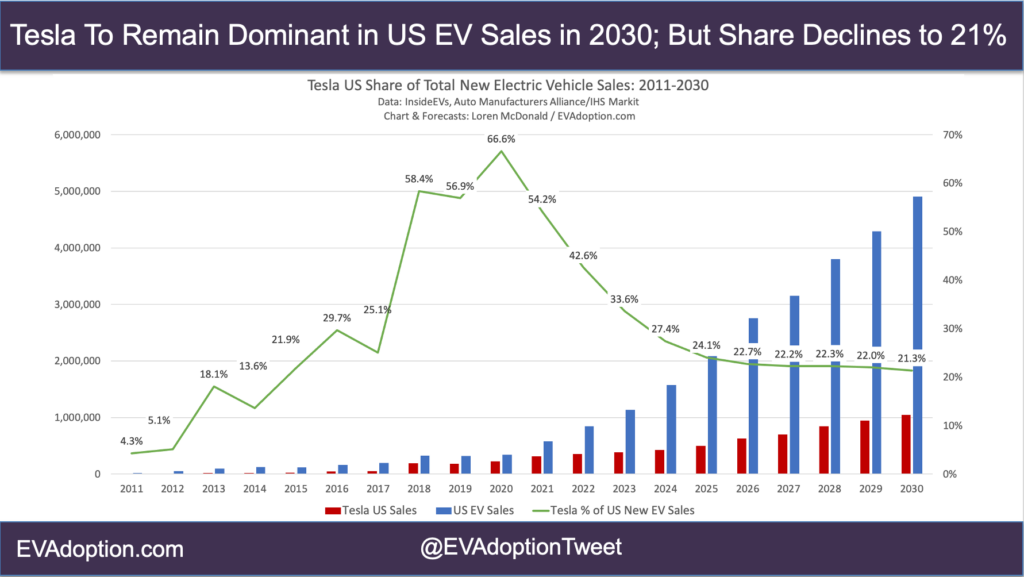

It’s no secret that Tesla dominates electric vehicle sales in the US with a sales share well above 50% since the launch of the Model 3 in 2018. However in my latest EVAdoption long-term US forecast I estimate that by the end of 2030, Tesla’s electric vehicle sale share in the US will drop to ~21%.

While this is a fairly significant drop in sales share from the 66.6% I’m forecasting for 2020, it is not unexpected as the other OEMs gear up EV production. I’m forecasting Tesla US sales will increase to about 1.05 million in 2030 from 226,010 in 2020 – an increase of roughly 4.6 times 2020’s sales.

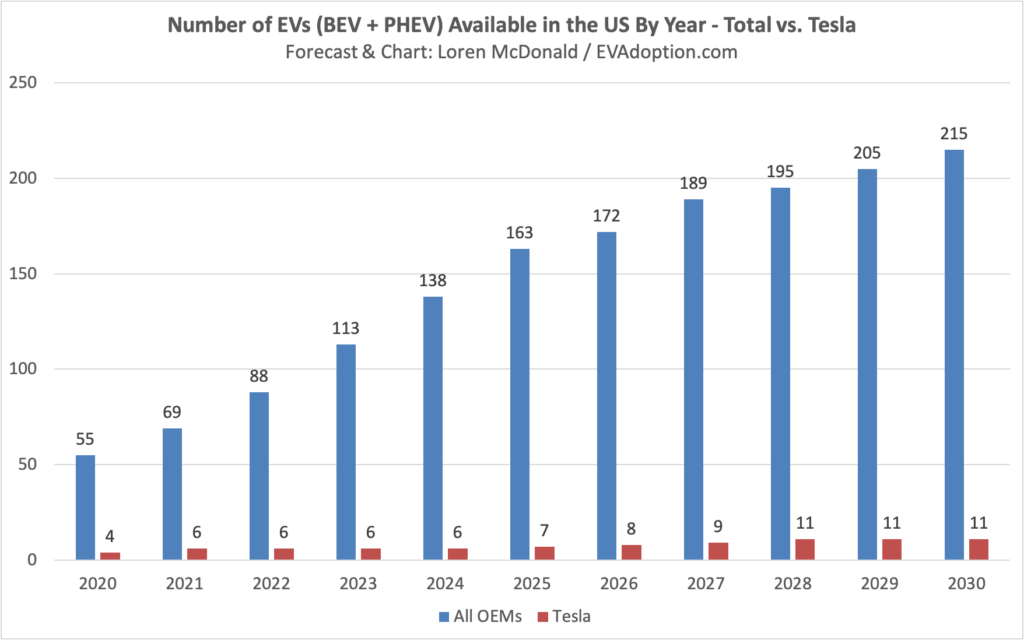

I recently completed an overall US EV (including both BEVs and PHEVs) sales forecast out to 2030 that includes the number of EV models growing from the 55 EVs available during 2020 to 215 at the end of 2030.

The number of Tesla models could increase to 11 from the current four. The additional 7 models potentially being the:

- Cybertruck

- Roadster

- Model “2” (a small Civic-sized sedan or hatchback)

- Small/mid-sized pick-up

- Large SUV

- Small SUV

- And the long-rumored (via Elon Musk) minivan.

The biggest declines occur during the period of 2021 through 2025 when Tesla’s EV share falls to 24%, but then remains relatively steady in the low 20s the remainder of the decade. From 2020 through 2025, when overall EV sales are still relatively low, an estimated 100+ additional new EVs will be available in the market. During this period of significant EV sales growth among other OEMs, Tesla will likely add 3 new models – the Cybertruck, the very low-volume Roadster, and possibly the small “Model 2” that is likely being designed primarily for China and Europe.

Even at around 21%, however, that would mean that 2 out of every 10 EVs purchased or leased in the US are Tesla models, from the current 6.5 out of 10. In 2019, the Ford brand (not including Lincoln) had the highest percentage of total overall US vehicle sales at 13.4% – so Tesla’s ~21% share of just EV sales would still be impressive from a market share perspective.

Looking at the above chart starting with the original Roadster back in 2011, you can see how Tesla’s share of EV sales increased after the Model S launched in 2012, then the Model X in late 2015, and the Model 3 in mid 2017 and then the Model Y in 2020. And while we might see a low-volume of Cybertrucks reach customers in late 2021, sales of the Model S and X are likely to be flat or decline and the Model 3 will likely be flat or see a slight increase or decrease in units delivered as the more popular crossover form factor of the Model Y steals sales from its sedan sister model.

Of course, a lot can happen in the next 10 years that could impact Tesla’s EV sales share. My latest overall forecast is fairly aggressive and assumes that the legacy automakers actually deliver on bringing about 180 more EVs to market (I anticipate some PHEV models being discontinued), they produce them at scale, don’t have battery supply issues, and consumers really begin to be comfortable buying them in large numbers beginning around 2024 or 2025.

Because of Tesla’s innovation, speed and aspirational brand, growing its sales at a steady pace over this decade seems likely – the question becomes how quickly and at what scale will consumers buy EVs from automakers other than Tesla. Besides its EV-only brand and focus, direct sales model, superior battery efficiency and range – Tesla’s network of Supercharger DC fast chargers continue to be a significant competitive advantage for consumers leery of taking road trips in an EV.

Current 2020 Estimates

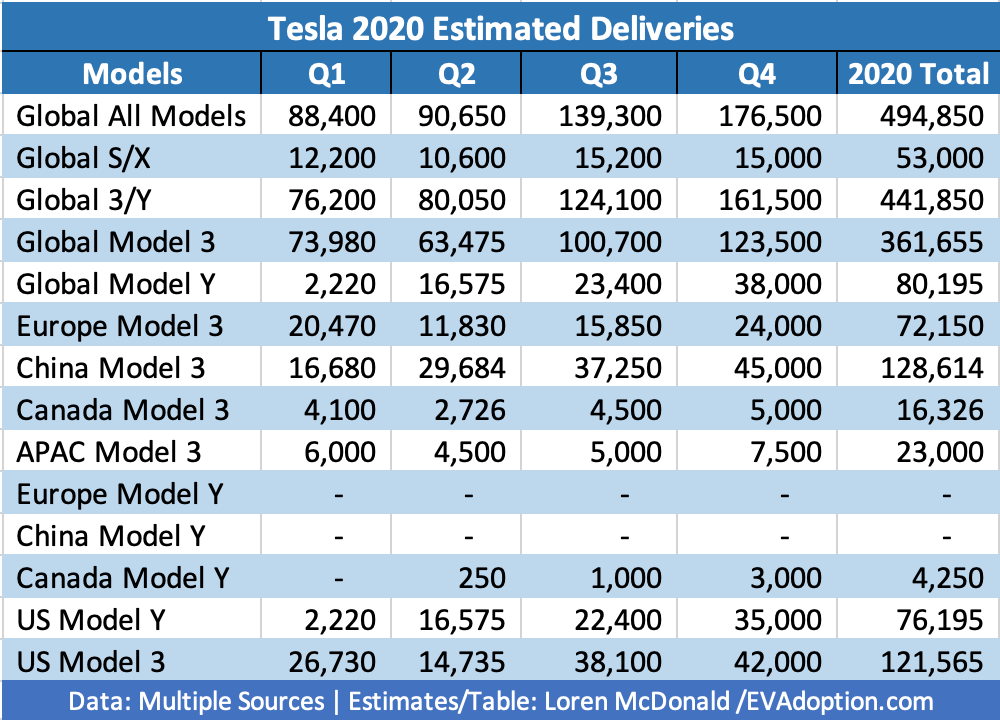

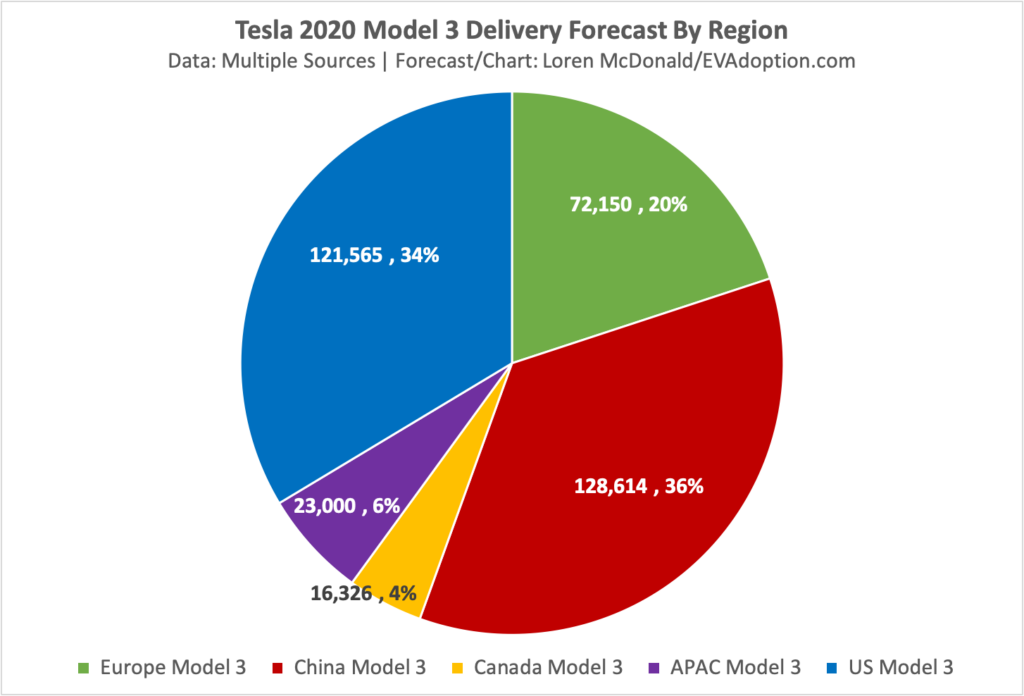

For 2020, my US forecast is that Tesla will deliver 226,010 vehicles (Models S, X, 3 and Y). The company’s US sales under my forecast would account for 45.7% of global sales.

And sales in China of the Model 3 could account for 36% in 2020, more than the 34% in the US – which shows the importance of China to Tesla’s future.

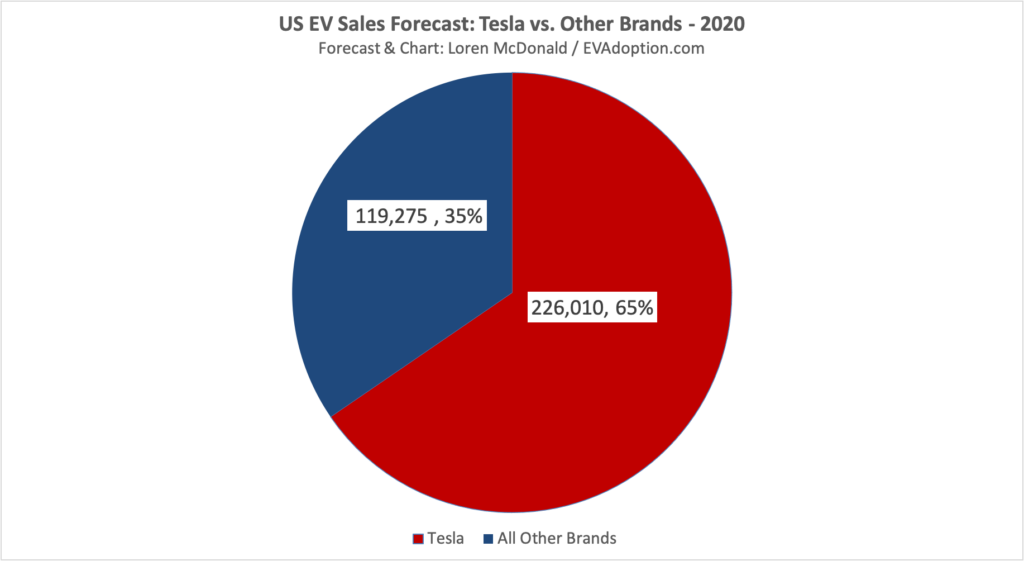

For the year 2020 in the US, I’m forecasting that Tesla will account for 65% of all (BEV and PHEV) electric vehicle sales in the US.

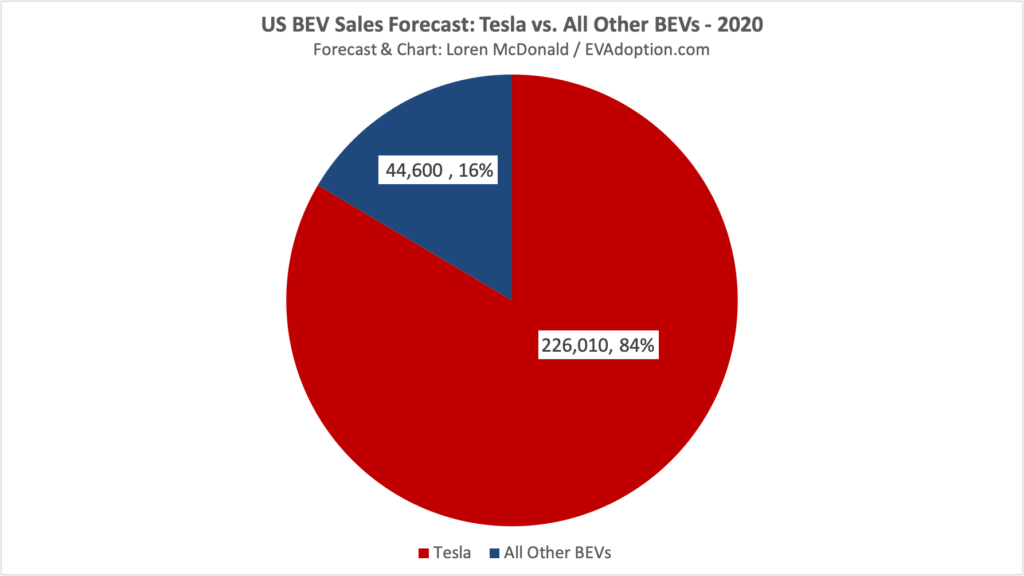

And when only including only BEVs, Tesla has a crazy level of dominance at 83.5% of BEV sales.

The next 10 years of electric vehicle adoption in the US are going to be fascinating to watch. I expect Tesla to remain far and away the sales leader in 2030, but several other automakers including Toyota (because of its PHEVs), Ford, Volkswagen, Rivian, and Nissan will grow their market and chip away at Tesla’s dominance.

10 Responses

While I think the 2030 markets share estimate is pretty reasonable, it will likely be a much less steep ramp down, initially. I see most of the dip coming post-2025 when OEMs really commit.

By contrast, you are estimating only 1M Tesla sales by the end of the decade. Giga Austin and Fremont alone will already have that capacity by the end of 2021. Will they settle for 9 years of zero growth? Seems extremely low-ball to me.

Most of the OEM moves so far seem to be still on the fence; keeping those options open as a hedge for if/when battery prices drop enough for them to make decent margins on EVs. So, I see them really starting to make major efforts after that point (probably 2022/2023).

On Tesla, my focus was not on the capacity of the factories, but what level market demand will be in during those years, competition, and segment demand. S and X will likely remain flat or decline. M3 has likely peaked – MY will grow strongly. Cybertruck will do well, but not in the volumes I think a lot of others expect.

By 2025 Tesla will be over a 15 year-old company with 3 models that have been in market from 7 to 13 years.

I think you have overlooked the fact that the M3, S and X will all be much improved by 2025, possibly replaced. There won’t be cars getting exported to Europe or elsewhere, giving Tesla more production to sell in the USA. Increasing efficiency and production numbers will also allow them to cut prices, making their cars even more competitive than they are now..

On the S and X, yes they will be improved and prices keep coming down; but they are in a small segment of premium sedans and SUVs. Competition is also coming (or here) from Lucid, Polestar, Mercedes, BMW, Audi, Porsche, Cadillac, Rivian (SUV), Jaguar, etc. The Tesla S and X may have better specs combined with the SuperCharger network – but not everyone wants a Tesla. The market for S and X has a low upper limit.

Model 3 is different. M3’s biggest challenges are: 1) Sedans are out of favor. The reason the M3 has done so well to date is that people wanted a lower-priced Tesla, preferred a CUV or SUV, but didn’t want to wait for the Model Y. 2) The Model Y. We are already seeing in California that MY sales are outpacing M3 and MY production volume hasn’t yet scaled. Model Y will cannibalize a lot of M3 sales – the question is just how much?

The one opportunity for the Model 3 is price. If Tesla focuses on keeping the Y priced quite a bit higher and maintaining margins, but continues to lower the price into the mid $30s on the 3, then it has room to grow simply based on price. So, we will see what Tesla does and how the market reacts.

Tesla makes the safest cars ever made. And they are getting better every year.

Nobody else has or is even working on a fast charging network.

Two items.

First, Tesla will be producing their $25k Model 2 compact vehicle beginning 2022. I’m convinced that this vehicle will boost Tesla global sales by an order of magnitude which is not reflected in your analysis. This vehicle is missing from your estimates. While this article was written in Oct ’20, the Model 2 was announced in Sep ’20, so it’s absence is suspicious.

Second, your estimates are based on the growth of Tesla’s competitors, with the caveat that there are no battery supply constraints. I think this assumption is the critical flaw in your analysis, as BEV production is the single largest bottleneck to BEV production capacity. I’m curious what data you’re using to justify your caveat, as it requires other automakers to have roughly 4x the EV battery production capacity of Tesla, despite dedicated EV battery factories announced for the decade being nowhere near sufficient to support that figure.

At their Sept 2020 Battery day, Tesla demonstrated how they will achieve 2TWh+ of battery production capacity to support 20M BEVs by 2030. At that time, GM and VW had one 40GWh battery GF in production each, to support 400k BEVs each by 2023.

In 2021 VW revealed they will be building an additional 5 battery GF for a total capacity of 240GWh & 2.4M BEV by 2030, most of this in the Euro market.

So far GM has announced they will be starting a second 40GWh battery GF in 2022, giving them a total EV production capacity of around 800k BEVS by 2025.

Ford and VW will be sharing an SKI battery GF in Georgia, splitting battery production to support 400k BEVs by 2023.

Meanwhile, Tesla produced 500k BEVs globally in 2020, (220k US Sales) and is projected to produce 1M BEVs globally for 2021, and 3M+ by 2025 once GF Berlin and Austin have reached peak production.

This gives the big 3 US BEV automakers combined a battery constrained total production capacity of 1.5M BEVs by 2025. By which time Tesla is expected to be producing 3M BEVs, or roughly 67% of the market.

Your projections show Tesla having reduced to 24% of US BEV sales by 2025. This would require other automakers to be making a combined 9M BEVs by 2025, for which they simply do not have sufficient battery production to support.

By 2030:

GM has committed to a total of 8 GF. At 40GWh each, that’s 320GWh of batteries for 3.2M vehicles, more than their 2020 total sales.

VW and Ford have made no further US battery factory commitments, but assuming VW paces their European battery rollouts, they might have a total of 6 GF, 240GWh of batteries, shared with VW, for a combined total of 2.4M vehicles.

Meanwhile, Tesla plans for 2-3TWh of batteries by 2030, for a total BEV production upwards of 20M vehicles. Assuming sales are split between US, Europe, and Asia, that’s roughly 7M US BEV sales, out of a battery constrained total projected production capacity of 12.6M, or roughly 60% of the US BEV market. US total new auto sales for 2020 was ~14M. Disruption growth patterns project that BEVs will comprise +80% of vehicle sales by 2030, so ~12M BEV sales by 2030 tracks.

To support your thesis of Tesla falling to 21% of US BEV sales by 2030, all other automakers would need to be making and selling a total of 28M BEVs, in an automarket that peaked out at 16M annual sales.

But this assumes that the introduction of Robotaxi and Transportation-as-a-Service doesn’t begin reducing global vehicle sales beginning 2025.

TLDR: with or without your flawed assumption, your math doesn’t hold water.

Carter. Thanks for the detailed analysis and response – I don’t have the time now to respond to all of your points. I’m just not as bullish on Tesla as you are – I have them however continuing to have the largest market share of BEV and EV sales in the US in 2030. But my forecast is currently that EVs overall will reach about 28% sales share of about 16.5 million total vehicles – that puts Tesla US sales at about 1 million. So that would mean the other automakers would only need to produce about 3.6 million EVs.

EV sales could reach perhaps 40% sales share if several states institute ICE bans and Biden’s investments really take off. But there are a lot of ifs and much of the US population is less than excited about EVs. A lot can happen in the next 9 years – so nothing is certain for Tesla or the EV market in general.

Elon Musk recently stated that US electric production would have to double to reach all the goals our government talked about for the year 2030. IMO, if they started building new plants to increase production to meet demands put on the grid by millions of electric cars running around every day they would have to start the project 10 years ago. I just don’t see it happening. The Canadian minister of energy said that if 10% of Canadians owned electric cars and were charging them every day the Canadian grid would shut down,,, they just don’t have the capacity to charge cars for only 10% of their population. My guess is that the USA is pretty much in the same boat as Canada.