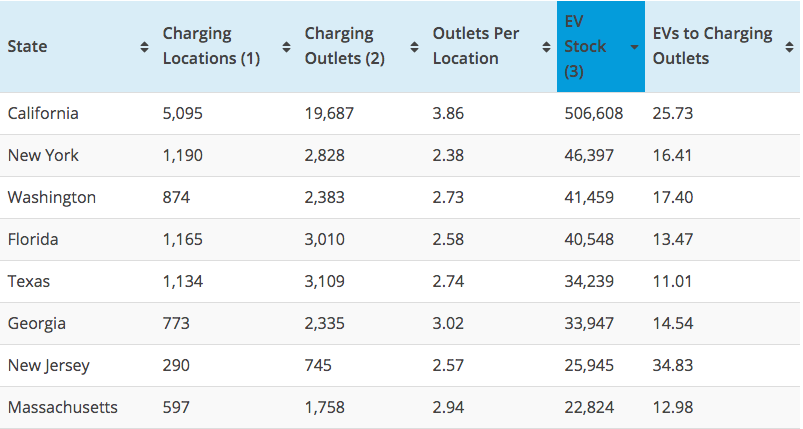

In part 1 of this series, What Is The “Minimum Acceptable” Ratio Of EVs to Charging Stations?, I asked and explored the question: How many EV charging stations are needed in a market to achieve a reasonable equilibrium between the number of EVs and available public charging stations?

While the International Energy Association (IEA) has recommended on a European level a ratio of 10 EVs to 1 charging connection, my assessment is that at least for the next 5-7 years, a ratio of 15-25 to 1 will in fact meet demand in most markets.

In this part 2, I’ll explore the various factors – including autonomous vehicles, ride sharing, super fast charging rates, BEV/PHEV mix and more – that will affect what will eventually become the “ideal” ratio of EVs to charging stations in a regional market.

8 Factors That Will Affect the Ratio Of EVs to Charging Stations

With the discussion around actual and likely future ratios of EVs to charging connections behind us, let’s explore the various factors that will affect the eventual ideal ratio at the individual market level. There are at least 8 key factors that will impact the number and ratio of EV charging stations in a regional market, and evolve and change over time. These include:

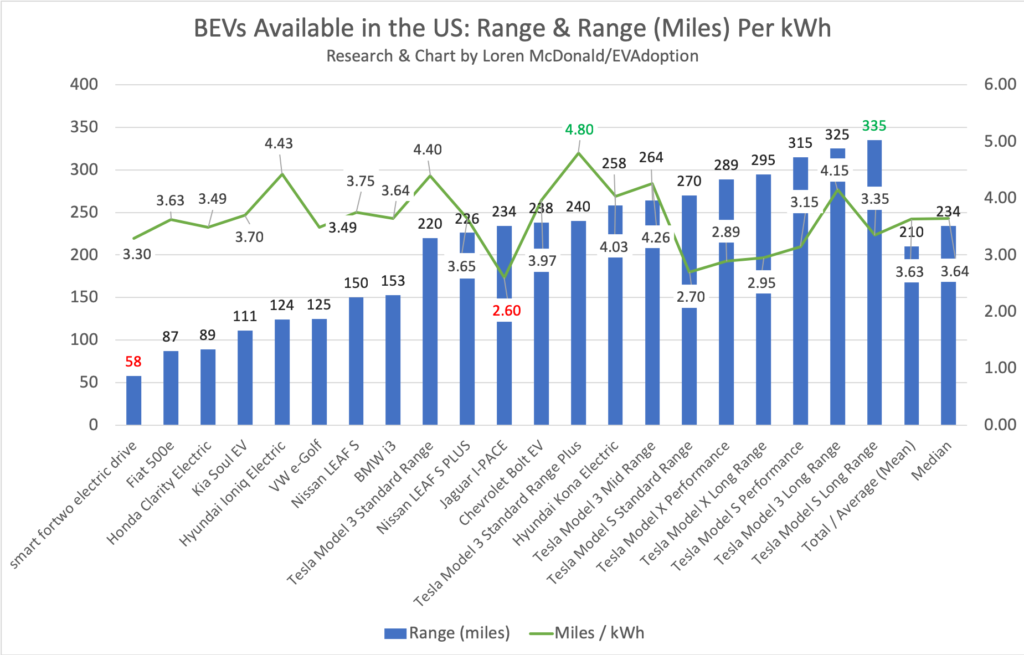

1. Typical Range of EVs: Currently in the US, the median range of BEVs available for sale is 234 miles (mean is 210 miles), but I forecast it to reach a median of 275 miles by 2022, 300 by 2025 and likely 350 by 2030.

Longer range BEVs affect the need for charging in a variety of and sometimes conflicting ways:

- More BEV owners will be comfortable taking their cars on long road trips, increasing the demand and need for more DC fast charging stations along major interstates.

- A reduction in the frequency of charging needs for commuters and renters. EV owners in major markets with long daily round trips of 50-100 miles and driving an EV with 300 miles of range may only need to charge every 2-3 days versus nearly everyday.

- Workplace charging can take on a more strategic role as commuters can top up at work every few days instead of perhaps daily. As EV adoption increases, employers offering workplace charging will have to significantly increase the number of charging stations, but will likely need fewer per number of employees with EVs.

2. Mix of BEVs versus PHEVs: The ratio and type of charging stations required (mix of DCFC versus Level 2) in a market will evolve over time in individual markets based on the number and mix of PHEVs versus BEVs. Level 2 charging stations are ideal for PHEVs, which in the US, for example, have a median range of 21 miles. This means that PHEVs can easily add several miles or recharge completely during short stops at grocery stores, restaurants or municipal parking lots.

In markets where BEVs increase their share at a quicker rate, then the need for more urban DC charging stations and workplace charging will be needed so that EV drivers can add 100 miles or more during shopping runs or while eating at a restaurant.

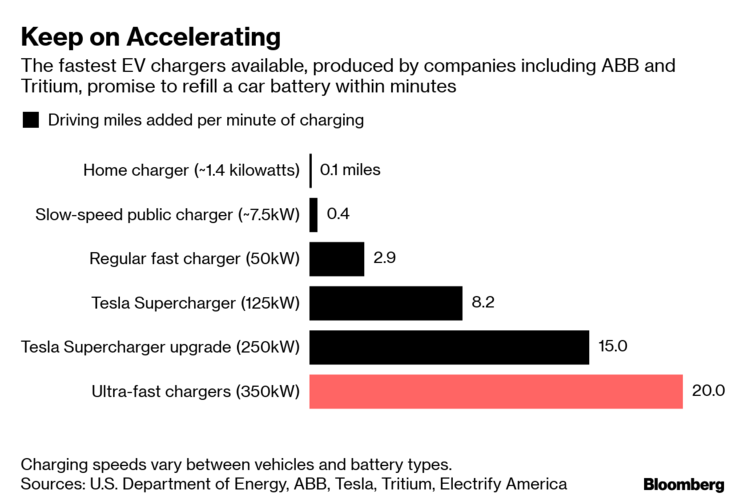

3. Charging Speed: Tesla, Electrify America, IONITY and other charging networks are rolling out new DC fast charging stations with the capability to add up to roughly 200 miles of range in 15-20 minutes.

A DC fast charging location with 10 chargers that currently can handle say 15 charging connections during a 60 minute period, might in the future see say 40 EVs charge in that same duration. If the charge rate is twice as fast, simple math says twice as many cars might charge in the same duration. But additionally, with faster charging also comes a likely increase in “graze charging.”

If a driver can add 125 miles in around 10 minutes they may simply stop, use the restroom and buy a cup of coffee and then drive on to their destination or next stop 2 hours later for a full meal where they then might add 300 miles of range in around 30-40 minutes.

Faster charging speeds might lead to fewer (on a relative basis) charging stations needed per location, but an increase in the number of locations and overall net increase in connections. While hard to predict, faster charging could lead to a lower ratio of EVs to charging stations due to a potential increase in locations and drivers moving more to graze charging.

4. Autonomous Vehicles: Despite all of the hype around autonomous vehicles, we are likely many years away from robotaxis running rampant around our cities.

Except for Elon Musk, CEOs of Waymo, Ford, Uber and others have all recently stated that widespread adoption of autonomous vehicles is many, many years away. As such, for likely at least the next 5 to 7 years I do not see autonomous vehicles, especially those in ride-sharing networks, to significantly impact or reshape public charging stations.

There are likely to be several test charging station centers for Uber, Lyft, Waymo and Tesla in a select few markets but it’s unlikely that we will see widespread deployment of dedicated charging stations for a autonomous vehicles for another 10 years.

If and when autonomous vehicles are widely adopted, we will of course see a shift towards centralized and specialized charging centers with wireless charging. Many of these charging depots will be located at airports, stadiums, concert venues, areas with heavy nightlife, shopping and entertainment traffic.

With the eventual growth of autonomous vehicles, individual ownership will decline meaning there will be a declining need for normal charging stations, but an increase in these centralized AV charging hubs.

5. Ride sharing: As ride sharing services such as Uber and Lyft continue to grow in use, they will impact charging requirements in at least two ways:

A. Currently only a small percentage of ride-sharing drivers use EVs because of cost, model availability, range and most significantly the time required to charge. Unlike for consumers, when an EV is plugged in for a ride-sharing driver it means they aren’t making any money. (Of course these drivers need to rest and sleep, but during the course of their core driving hours, down time is costly time.)

As BEVs become more affordable at less then $30,000-$35,000, with ranges at or near 300 miles and faster charging rates – BEVs will become more more attractive to ride-sharing drivers. This “fleetification” of EVs as ChargePoint CEO Pasquale Romano calls it, will drive the need for fast charging stations that are dedicated to these drivers and are strategically located in high demand locations.

These charging “depots” will require convenient access to restrooms and quick service meals and beverages. But, as wireless charging speeds increase and wireless stations become more available, these ride-sharing drivers may also do quick spot charges for around 5 minutes (at less cost) between fares.

B. The second impact of the growth of ride sharing is that more households, especially in cities and more dense suburbs, may choose to go carless or choose to have only a single car, where previously they might have been a 2-car household. In markets where ride sharing grows significantly in popularity, it again speaks to the need for a shift toward the above described charging depots with both fast-charging and wireless charging access.

6. Wireless Charging: The future adoption and impact of wireless charging for EVs is hard to predict, but it portends to play a role in graze charging for ride sharing drivers and shoppers. While plugging an EV charging cable into your car is a simple, quick and easy process – especially at home – there are use cases that benefit greatly from the convenience of wireless charging.

One of the most obvious is charging infrastructure for taxi and ride sharing EVs. A new program is being launched in Norway, for example, that enables taxis to charge while in the queue waiting for passengers. As these drivers move up in the line their EVs can simply charge at each stopping point without drivers having to get out and plug in and unplug charging cables.

This scenario will likely also be popular for consumers stopping off for 5-10 minutes to pick up coffee or a fast or quick-service meal.

Eventually, we may also see that EVs with summon parking capabilities can be moved remotely after being charged to a non-charging location and freeing up that wireless charging station for others.

Finally of course, are autonomous vehicles themselves. While as mentioned earlier, I believe we are many years away from robotaxis running rampant in major markets in the world, wireless charging will likely be the primary way these vehicles are charged.

So what does the future of wireless charging actually mean to the number of EV charging stations needed? It is likely that as wireless charging becomes widely adopted that many of these public charging connections will not replace or be substitutes for wired stations, but will be supplemental.

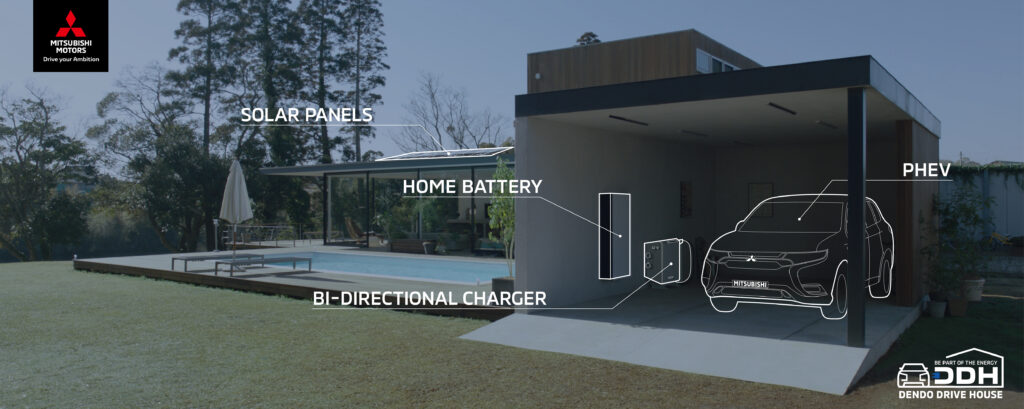

7. Adoption of Vehicle to Grid/Home/Building Technology: Vehicle to grid functionality will prove to be perhaps the most exciting and biggest benefits of the transition to electric vehicles. While currently only the Nissan LEAF is capable of of both charging and discharging, in the next five years I expect several EV‘s to be vehicle to grid ready.

Mitsubishi, for example, recently announced its Dendo Drive House (DDH) which includes solar panels, battery storage, and a bi-directional charger that enables power to flow from your home to your car, or from your car to your home.

Several other companies including start-ups like Fermata Energy are developing special two-way capable charging stations and the software to manage vehicle to building demand response systems. Fermata Energy is initially focused on enabling businesses to use employee and fleet vehicles to minimize or reduce expensive utility demand charges during times of peak energy use.

In 10 to 15 years I expect to see V2G/V2H take off in residential single family home use, but it is not likely to have a significant impact on the demand and type of public EV charging stations.

There could be, however, a significant impact in workplace charging as businesses are motivated to install these two-ways systems as employee charging benefits and to reduce peak energy charges. Apartment owners may also adopt two-way chargers and demand response systems to minimize energy costs for apartment complexes as a way to rationalize the investment and EV charging stations.

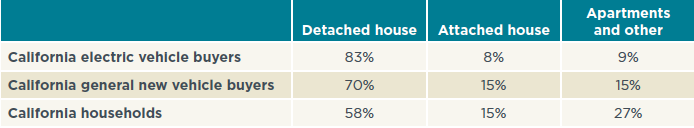

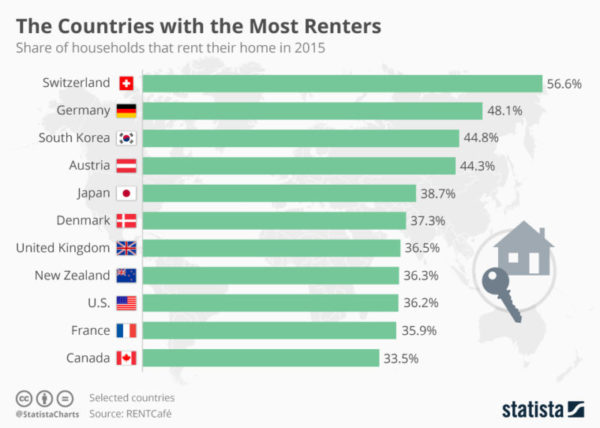

8. Increased Adoption of EVs by Renters: As a growing number of EV buyers are renters and others that do not have convenient access to home charging, the need for Level 2 charging at apartment complexes and condominium garages will become key. (see Stat of the Week: Percent of Households That Rent By Country)

While most owners of multifamily housing units are currently reticent to install charging stations, within the next 5-7 years in early adopting markets, multi-family housing that doesn’t offer adequate Level 2 charging station access with be at a competitive disadvantage. Secondarily, concentrated charging centers with Level 2 and fast charging will grow in importance in areas with a high concentration of multifamily housing.

With the large and growing need for more charging stations for renters, this will likely have a significant impact on and reduction in the ratio of EVs to charging stations.

What are your thoughts? Did I miss any key factors or get any wrong? Let me know in the comments.

7 Responses

One thing that I wonder is the EV chargers’ impact on the grids. Is a few fast chargers at one location accepted at any place? To my impression, it is about as much load as some middle-class factory.

Fast chargers will likely increasingly be co-located with microgrids or at minimum with battery storage. The battery storage systems can do trickle charges from the grid in the middle of the night, for example, but then discharge to the DC fast chargers as several cars charge simultaneously.

Interesting post. I think you’re overestimating how much ride share drivers will need to charge during their work. A quick check shows that full time drivers might average 1,000 miles/week on these services. That’s under 200 miles per day, largely at low speeds which means more miles/kWh. A Bolt or Tesla 3 can handle this just fine, and I think you’re right in assuming that range is only going to go up (so this will just get more and more true). The main reason I can see them needing to charge during work is if they can’t figure out a way to have an L2 charger refill their car overnight, but if they’re driving full time I think they’ll figure this out.

This ties in to your apartment charging note, as many drivers may be living in such homes. As EV adoption picks up I think landlords may actually see installing chargers as lucrative because they’ll have such a high usage rate (far more than highway chargers that will only be used sporadically). They could profit by charging a monthly fee for access, adding a per kWh fee, or both. An Uber driver going 50,000 miles per year would need 12,500 kWh to power this. If the landlord charges an extra 4 cents per kWh that’s $500 every year. How long this takes to recoup depends on charger cost, but if they can do it for $1,000 it’s a no brainer and even $3,000 is tempting (because the charger should deliver revenue well beyond the 6 year payback period). In PA the extra 4 cents/kWh would be a big increase to our normal 10.5 cents/kWh rate, but the total 14.5/kWh price would still get an EV 27.5 miles per dollar. A 35 MPG car can’t touch this and a 55 MPG prius would need $2 gas to match this while still having far higher maintenance costs. It’s most likely that one of the charging networks will actually manage the installation of such meters, not individual landlords, but if demand is there they can basically provide these installs for free and still make money.

The problem related to multifamily owners is most right now do not want the capital outlay to install L2 charging stations, dealing with the parking issues, complaints, the billing issues, etc. Many will say “we are not a gas station, it isn’t our responsibility to provide refueling for our tenants.”

These are real estate owners who flip their properties and will put capital dollars into repairing cracks in walkways, paint jobs, new roofs, etc … things that are necessary .. but not something like EV charging stations.

One EVs have a higher market share and owners start to see that they are losing existing tenants or not closing a decent percentage of new tenants due to no charging stations, then things will change. Until then only the forward thinking, big institutional grade owners will make the investment.

I think you’ve hit the nail on the head when you state that multifamily houses will be at a competitive disadvantage if they don’t have ev chargers. I live in a condo apartment complex in suburban DC and I am seeing examples of more upscale communities that are offering ev charges in their advertisements. Unfortunately, my Board of Directors isn’t interested in even hearing about this subject.

I think you’ve hit the nail on the head when you state that multifamily houses will be at a competitive disadvantage if they don’t have ev chargers. I live in a condo apartment complex in suburban DC and I am seeing examples of more upscale communities that are offering ev charges in their advertisements. Unfortunately, my Board of Directors isn’t interested in even hearing about this subject.