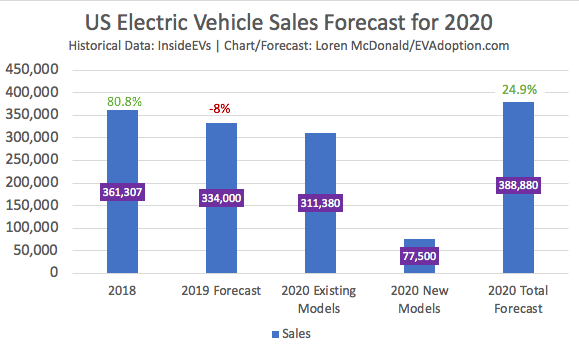

Sales of electric vehicles will return to positive growth in 2020, with a forecasted volume of new BEV and PHEV sales of 388,880.

At this forecasted level and 2019 estimate of units sold at 334,000, 2020 would achieve a respectable YOY growth rate of 25%. This is compared to an estimated decline of about 8% in 2019 versus 2018 and 81% increase in 2018 versus 2017.

Sales of existing models (those available in 2019) I expect to decline more than 20,000 units in 2020. Key models that I expect to see sales declines include:

- Chevrolet Volt: The Volt is no longer being produced, but will have sold about 5,000 units in 2019.

- Toyota Prius Prime: The Prime PHEV has been the number 2 selling EV in the US the last 2 years, but will drop significantly in 2019 from 2018. With the Toyota RAV4 Prime PHEV coming to market in 2020, along with Ford Escape PHEV, and Tesla Model Y BEV – the Prius Prime should take a huge hit in the second half of 2020.

- Honda Clarity PHEV: The Clarity was a hot seller in 2018, coming in #5 with 18,600 units sold according to InsideEVs. But 2019 will see the Clarity PHEV’s sales drop to about 10,500. It could end up even lower in 2020 with so many new PHEVs coming to market.

- Ford Fusion Energi: The Ford Fusion Energi will continue being produced into 2021, but with the Ford Escape PHEV coming to market in 2020, it could take a hit in sales volume.

- BMW i3: The i3, one of the top selling EVs a few years ago, has become an also ran with its now very uncompetitive under 200 miles of range.

- Other models: Dozens of other EV models are simply compliance cars and not competitive or will see new models from the parent brand steal mind and sales share. While none of these other models currently account for any significant volume, add up about 20 models with declining sales and 2020 starts out at a disadvantage.

New Models in 2020

In 2020 I forecast that sales from new models should account for about 78,000 units. These include:

- Tesla Model Y: 31,000

- Toyota RAV4 Prime: 12,500

- Ford Escape PHEV: 5,600

- Porsche Taycan: 4,200

- VW ID.4: 4,000

- Mini Electric Hardtop: 3,150

Wondering about the Ford Mustang Mach-E? Ford says that the Premium version, with a starting MSRP of $50,600 will be available beginning in late 2020. With most EVs seeing production delays and only one of the more expensive versions of the Mach-E being available, I’ve forecast sales of only 1,800 units in 2020. But I expect US sales of 35,000+ in 2021.

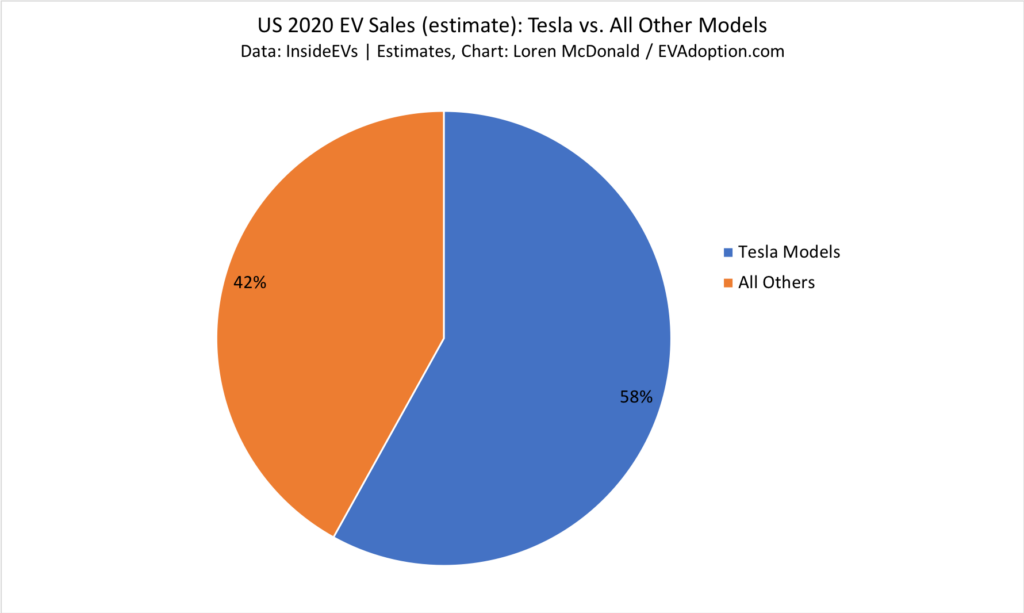

Tesla Continues Its US Domination

In 2020, I expect Tesla Models (3, Y, S, and X) to account for approximately 58% of sales. This breaks down as:

- Model 3: 166,000

- Model Y: 31,000

- Model X: 16,800

- Model S: 12,000

- Tesla Total: 225,800

As has been the case the last few years, forecasting US electric vehicle sales is fundamentally about Tesla Models, since they account for roughly 50% or more of sales. In 2018 and 2019, US sales have been all about the Model 3. In 2020, sales are again mostly about the Model 3, but the key variable is when Tesla will begin production of the Model Y and how quickly will it scale production?

The second key variable is whether many potential Model 3 buyers will hold off and instead wait to buy the more popular CUV form factor of the Model Y with its larger interior and taller ride? The third key variable in 2020 is the Toyota RAV4 Prime. I expect it to sell very well and replace much of the Prius Prime sales – but how well it will be received in the market and by Toyota dealers is a real unknown.

The final key variable for EV sales in 2020 will simply be the economy. With sales of autos slowing in general, the beginning of a slowing economy, and growing auto loan debt, EV sales could be significantly affected.

4 Responses

I think the biggest challenge for EV and especially BEV sales is overcoming the dealers resistance.

The USA used to be the Nissan Leaf’s biggest market. Now Nissan is on the verge on giving up on the USA for the Leaf.

Will Hyundai, Kia, Audi send enough supply to the USA or will they continue preferring markets with a more accommodating sales infrastructure?

VW will sell its ID.3 in Canada and Mexico, but not in the USA. Even if the USA market is only 10k or 20k, that is still a decent number for a new lower volume model. But without an effective distribution and sales infrastructure, it is just too expensive to export to this market.

With the way the current market is structured, the dominance of Tesla will likely grow before the system crumbles.

A single brand market is not a healthy market, says this Tesla fanboy.

P.S.

Thanks for your work and insights

Maarten, thanks for the comment and kind words. Not sure if you saw, this article I wrote, but agree in the US the issues is one mostly of supply, not demand – https://evadoption.com/ev-adoption-in-the-us-a-supply-rather-than-demand-issue/

The Hyundai/Kia supply issue was a particular disturbing factor in 2019 – the Niro and Kona BEVs should have sold 1,500-2,000 per month … and yet were only around 100/month.

I don’t blame VW re the ID.3 – I think it is the right decision for them … it likely would have sold well in the US, at least not enough to make financial sense.

Agree on Tesla. I’ve been harping on this the last few years, it is one of the main reasons I dislike all of the Tesla fandom (I drive and love my Tesla, but it is just a car) – because we won’t have madd adoption of EVs until consumers are exciting about buying EVs from non-Tesla brands. We need to stop focusing on how un-competitive all the other non-Tesla EVs are.

I’m a Tesla owner and evangelist. It’s OK to focus on how un-competitive the other non-Tesla EVs are because car buyers are increasingly selecting BEV first, then brand/model. I think that’s one of the key differentiators between the “new” market and the old market….the brand landscape is shifting, and maintaining the strength of brand is going to require tons of innovation and investment. No more small incremental gains, but pushing the energy density per dollar up and up and making the efficiency/recharging experience continually improving too. Tesla is motivated by the increased competition, why shouldn’t we focus on that advantage for now to motivate others?