On Friday March 22, GM announced that it will invest $300 million in its Orion Township, Michigan, factory (where the Chevrolet Bolt BEV is assembled) and it would launch a new BEV based on the Bolt platform. According to GM’s press release, “It (the new EV) will be designed and engineered off an advanced version of the current award-winning Bolt EV architecture.”

This is great news, though the timing of the announcement feels like it was driven by a need to minimize a public spat with President Trump. Shortly after the announcement I received an email from a representative of FleishmanHillard, one of the largest PR firms in the world, asking if I wanted to share the news of GM’s “commitment to EVs and the job growth …” Separately, but related, the Akron Beacon Journal reported that GM was entertaining offers for its Lordstown, Ohio plant.

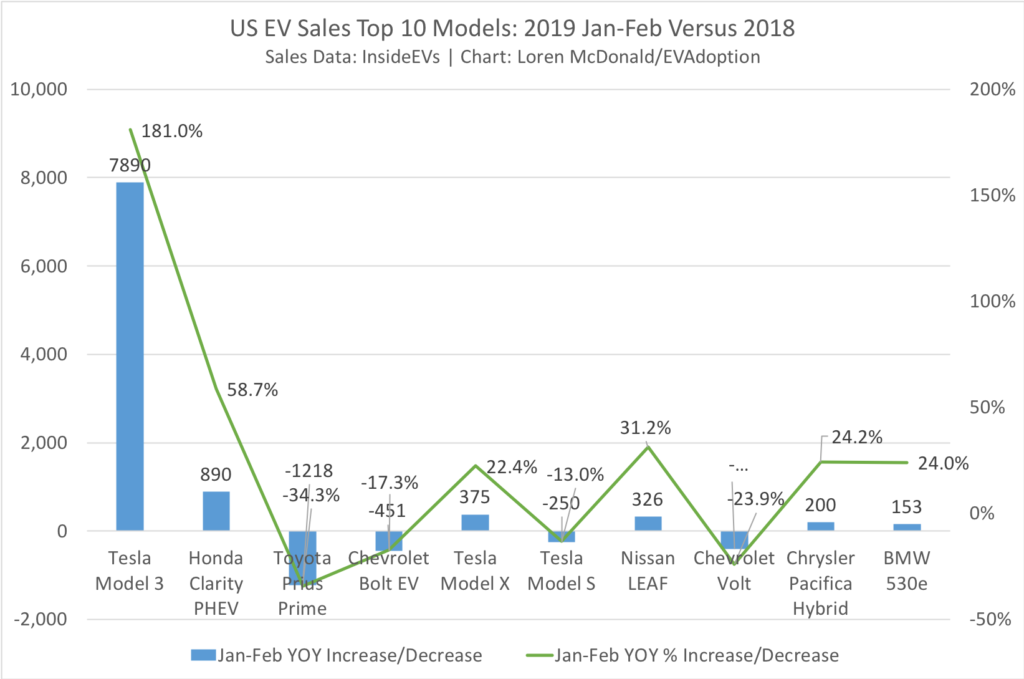

In recent months GM has ended production of its popular Chevrolet Volt PHEV, but also announced that its Cadillac luxury brand would eventually go all electric. Sales of the Bolt, however, have declined so far in 2019 and also declined in 2018 (18,019) versus 2017 (23,297).

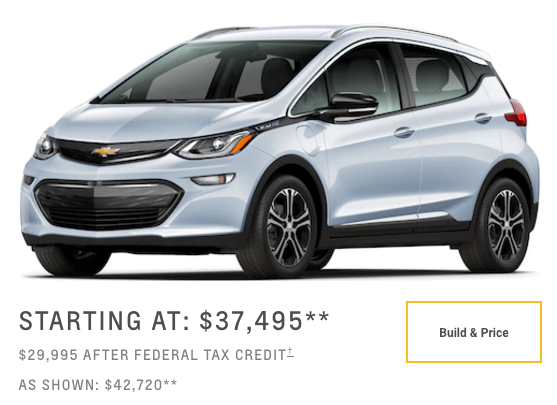

The Chevrolet Bolt was considered groundbreaking when it was launched in December of 2016 because of its combination of 238 miles of range, under $40,000 price tag and beating Tesla Model 3 to market. But while the Bolt is a competent EV, it didn’t excite the market of early-adopting EV buyers, many of whom were waiting for the conspicuous conservation of the Tesla Model 3. But there was also apparently greater demand for the Bolt than supply and GM was never able to get adequate supply of the battery pack and powertrains from LG Chem to meet a growing appetite for an affordable BEV.

So all of this leads to wondering what GM’s plans are for this new Bolt-based BEV? Will this new EV be mostly about PR until mass adoption of EVs in the US takes off, or will GM do everything within its power to make this as of yet unnamed EV a success? With this in mind, here are 10 key questions for GM:

1. Volume/Battery Pack Supply?: Assuming that GM is sticking with LG Chem as the supplier of the battery packs and powertrain for this new EV, will GM structure its contract to ensure that supply will scale to meet demand?

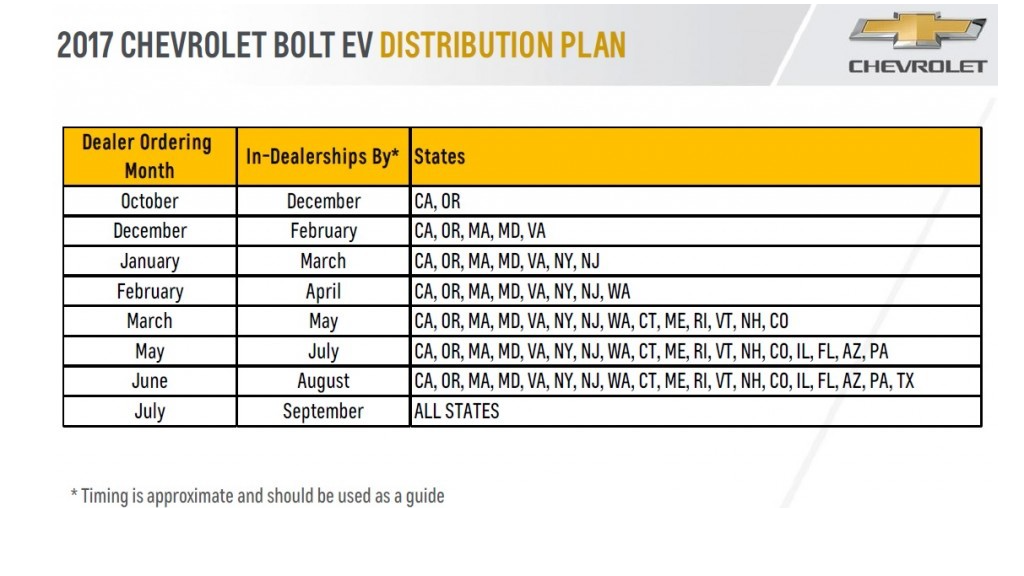

2. Distribution/Availability?: Strategy, production and battery supply obviously drive how many of these new EVs will be available, but the question of which US states these vehicles are available in and at what quantity is a key question. And if the partnership with LG Chem continues will US availability be limited with some percentage being produced for Korea and other international markets?

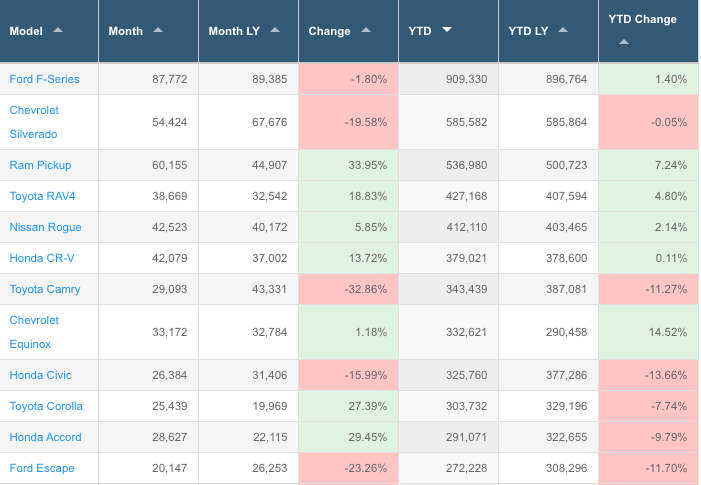

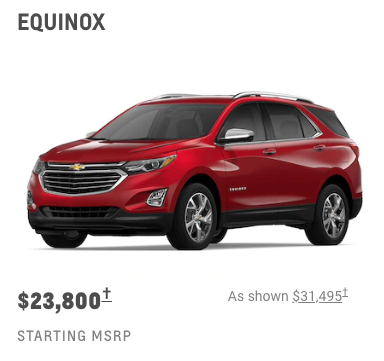

3. SUV or CUV?: It is pretty clear that this new Chevrolet will not be a pickup, sedan or hatchback (most consider the current Bolt a hatchback, though some consider it a CUV) so will it be a true SUV or a crossover. While the distinction between these two model types has become increasingly blurry and is often debated, what isn’t debatable is how hot the mid-sized SUV/CUV market has become.

In 2018, the Toyota RAV4, Nissan Rogue and Honda CR-V ranked 4-6 in US vehicle sales and GM’s Chevrolet Equinox came in at #8 and the Ford Escape at #12.) Will GM produce a SUV/CUV that buyers of these and similar models see as a viable and affordable alternative?

4. Price Point/Attractive Lease Option?: The challenge for GM if the automaker tries to compete in the small to mid-size SUV/CUV market is that their BEV offering is likely to be at least $10,000 more than traditional (and some of their own) ICE competitors. People will pay $45,000-$50,000 for a big Chevrolet Tahoe, but many will balk at at $40,000 for a non-luxury electric Chevrolet. Further, GM is launching a fully-electric Cadillac crossover likely in 2021, but concept images suggest it will be a full-sized CUV.

The small/mid-sized CUV BEV market is also starting to get crowded with the Hyundai Kona EV and Kia Niro BEV either available now or in a few months in the US and with the Tesla Model Y, Volvo XC40, Ford (unnamed) and Volkswagen iCrozz coming to market within two years.

The Hyundai and Kia are currently supply constrained, but may not be in two years. And the Tesla Model Y, while somewhat “normal looking,” will most certainly out perform and out “sexy” anything GM brings to market. And the Mustang-inspired Ford CUV and Volvo could also be quite attractive.

By the time GM’s new BEV reaches market the Federal EV tax credit will have completely phased out for its buyers (as well as for Tesla). This means that this model (and other GM EVs) will be at a competitive disadvantage against the Kona, Niro and similar EVs that will still qualify for the tax credit.

So how will GM position this new EV for success and against more affordable ICE SUVs/CUVs and very competitive EVs, many with the available Federal EV tax credit?

5. Charging Infrastructure? Two of Tesla’s biggest current advantages are its supply of battery packs through its joint Gigafactory with Panasonic and its Supercharger fast charging network. Without a significant partnership with EV charging networks and the buildout of DC fast chargers along key interstates and in key urban markets, any GM BEV offering will see a limit to demand.

GM did announced in January 2019 partnerships with EVgo, ChargePoint and Greenlots to enhance the charging experience for Bolt customers. This more seamless charging experience should help, but GM EV owners will still not have convenient access to as many DC fast chargers as via the Tesla SuperCharger network. What additional plans does GM have to reduce charging and range anxiety among its BEV buyers?

6. Range?: The Bolt’s range of 238 miles is very respectable, but the average range of new BEVs is heading toward 275 miles in the next few years. The Kona and Niro, which are priced close to the Bolt have 258 and 239 miles of range respectively and the Model Y will be available with 230, 280 and 300 miles of range. So will GM increase the range of this new BEV to say 260, or 275 miles of range to better compete with similar BEVs, or will they stick with the current battery pack and range of 238 miles to keep the price point lower?

7. Why a Chevrolet?: GM needs to do something to invigorate sales of the Cadillac brand and the move toward launching high-performance crossover BEVs is a sound strategy. But the Chevrolet brand is mostly a middle-America or truck/SUV brand (though even snobbish Californian’s love their Tahoes and Suburbans) – and this market of buyers won’t be ready in large numbers for BEVs for perhaps another 5-7 years.

GM should have learned from the reaction to the Bolt, which was positive and demand was solid – but it didn’t excite buyers. EVs are still fundamentally aspirational products or green signaling vehicles (for at least a few more years) – and the Chevrolet brand just doesn’t fit either bill very well.

As I wrote in the past about the Bolt, GM would probably be better served launching this new BEV as a Buick, even consider bringing back the Saturn brand or creating a Chevrolet EV “sub-brand.” But I suspect, unless GM positions this new Chevrolet BEV at a price point lower than the competition, it will struggle to find a market until middle America goes all in on EVs.

8. Marketing?: Will GM market the new EV at any significant level and more substantive than for what was done for the Bolt? I’m not talking about Super Bowl ads, but regional ads, test drive events, and heavy social media in major EV markets. Unlike traditional gas cars, EVs still require a lot of consumer education around everything from tax and utility incentives, types of charging, where and how to charge, and home charger installation options. Will GM partner with companies such as Amazon to sell and install EV charging stations for new owners as Hyundai, Kia and Audi are doing?

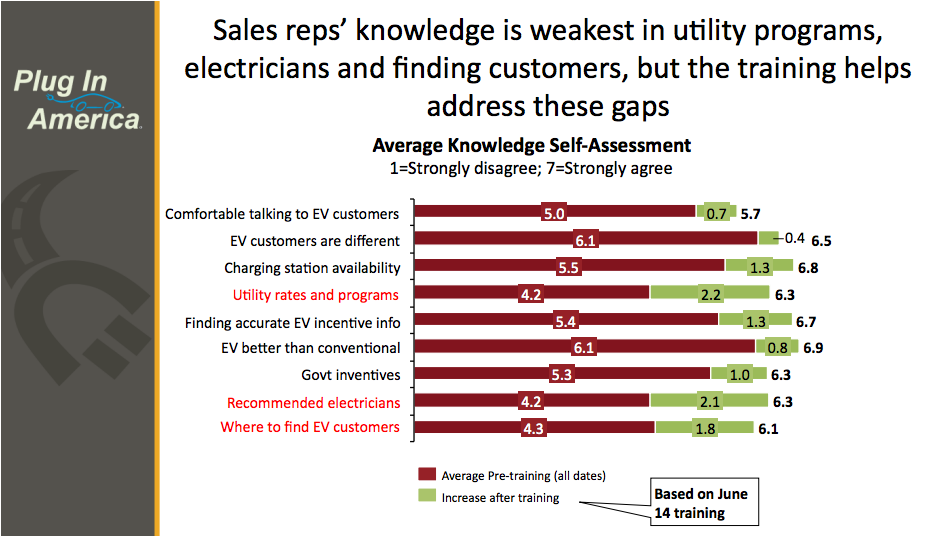

9. Dealer Training?: With this new EV, Chevrolet dealers will still have only two electric models to offer customers now that the Volt is no longer being produced, but both will be BEVs. In early 2017 I test drove a Bolt at a Northern California dealer (with an actual knowledgeable sales rep who himself drove a a Chevrolet Spark EV), but as many consumers have experienced the Bolt we drove had not been charged. It had only 12 miles of range so I couldn’t take it on the freeway and its short available range actually limited the car’s performance.

While these types of lapses are the responsibility of dealer management, what kind of programs will GM put in place to insure that dealers and their staff are fully committed to EVs and have processes in place to ensure a great customer experience during the EV buying process?

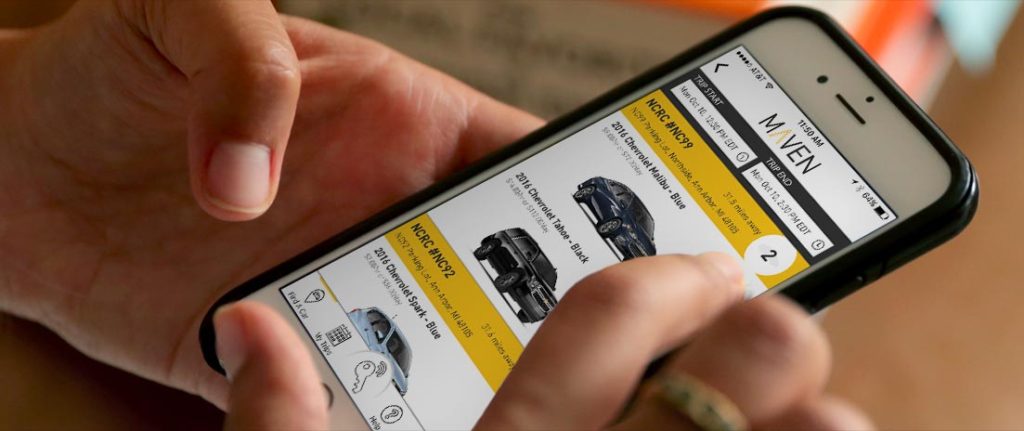

10. Ride Sharing/Fleet Market?: The ride sharing market is a huge opportunity for GM, especially considering their investment in Lyft and Maven ride-sharing lease program. To lead this market, however, GM must design a vehicle with a roomy interior (seats 4 passengers comfortably) and partner on a network of DC fast charging stations for drivers, starting in the largest Uber and Lyft markets.

On a recent trip to Atlanta I rode in Lyft car that happened to be a Chevrolet Bolt. The driver was happy with it, but being a renter he couldn’t charge up at night but had to rely on various EVgo and ChargePoint charging locations (DC fast chargers and Level 2). It was working reasonably well for this driver, but dedicated DC fast chargers for ride sharing drivers is a huge need and opportunity in the future for GM.

Secondly the fleet market in general – car rental, utilities, sales organizations, etc – is a huge potential market that GM should target with this new vehicle. Unlike consumers, fleet managers are less concerned about the brand attractiveness and are primarily focused on total cost of ownership over the life of the vehicles – and this could be a sweet spot for GM.

I’m excited that GM has committed to more EV production and jobs in the US and will be launching another BEV in the US market, but it remains to be seen how truly committed GM will be to making this model a success. And secondly, as a Chevrolet model, will brand-centric and conspicuous conversation-minded consumers be attracted to an electric Chevrolet when several directly competitive models from Tesla, VW, Volvo, Ford, Hyundai, Kia and others will also exist?

What do you think of GM’s plans?

One Response

Very good points. I think you are correct that Chevy will release a CUV/SUV as they already have the Bolt. If they are serious about EVs, they will offer it will AWD and price it under $40K. Otherwise, they’ll have an overpriced vehicle similar to the Kona (Kona ICE starts in the lower $20s while Kona EV starts at $37)