With record sales for the year, including the number of units sold in a single month (December), 9 new models reaching market and growing demand for the Chevrolet Bolt – 2017 was a strong year for electric vehicle sales in the US. But drilling down into the data uncovers that there were both winners and losers with many models actually seeing declines in sales versus 2016.

Analyzing data from the InsideEVs Sales Scorecard, I’ve identified 10 electric vehicle (EV) sales trends from 2017 and what many of them might portend for 2018:

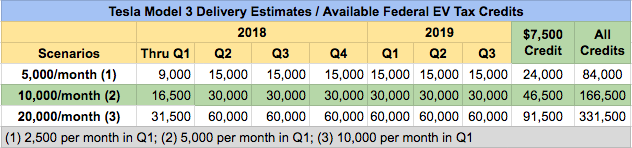

1. Tesla Model 3 “Production Hell”: Anyone who has followed Tesla for the last few years knew that there was a good chance the Model 3 would not reach production and delivery targets set by Elon Musk and the company. The company only delivered a total of 1,772 Model 3s in 2017, but according to Tesla, the Model 3 is apparently on track to deliver 1,000 units per week in January and scale up to a targeted 5,000 per week by the end of Q2.

Even if Tesla continues to have issues scaling production but averages 1,000 units delivered per week in the US, they would sell roughly 52,000 Model 3s in 2018, more than 70% higher than the previous record held by the Nissan LEAF in 2014 with 30,200 units sold.

On the upside, if production scales, Tesla could deliver 75,000-150,000 model 3s in 2018. And if Tesla can scale up Model 3 production, more than 330,000 US buyers could potentially take advantage of the Federal EV tax credit.

2. Chevy Bolt Ends 2017 Solidly in the 2nd Spot: The big EV sales news (other than the Tesla Model 3 production issues) in 2017 was of course the strong showing of GM’s Chevrolet Bolt, especially since April. Over the last eight months of 2017, Bolt sales increased each month to end the year at a strong 3,227.

If the Bolt only averages 3,000 sales per month in 2018, it would post the most EV sales ever in a year at 36,000. The Tesla Model 3 of course should greatly outpace the Bolt, but it will likely be the 2nd most popular EV 2 years in a row.

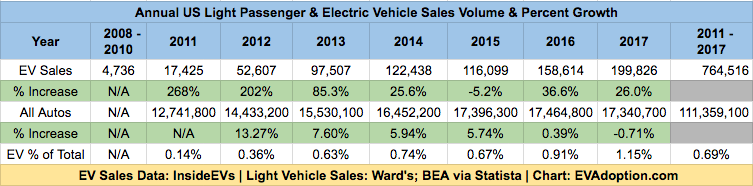

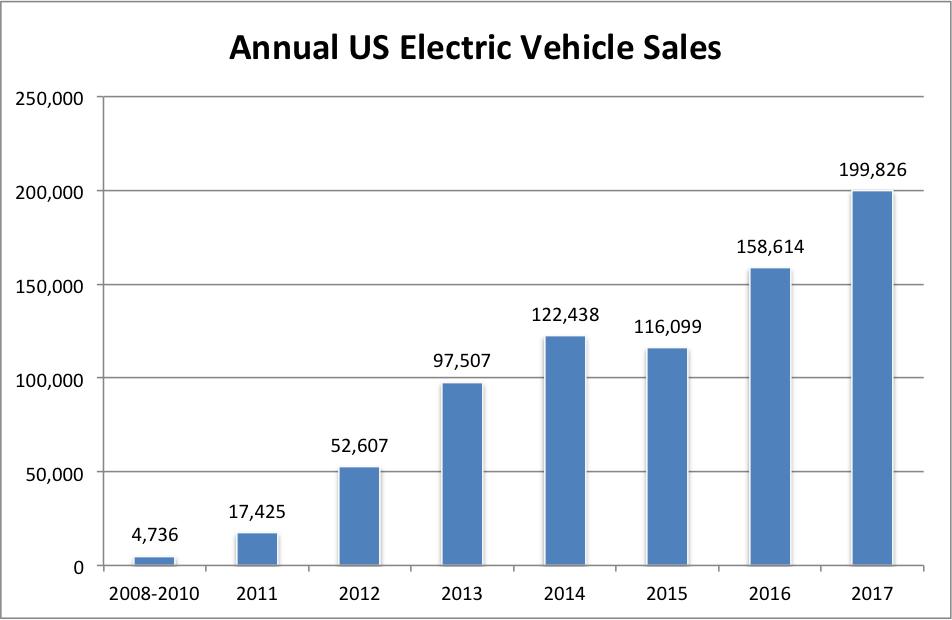

3. Sales Growth Rate Lower Than 2016: EV sales grew 26% to 199,826 from 158,614 in 2016. The 26% increase was 10 percentage points below 2016’s 36.6% increase over 2015 (which was a down year). For 2018, however, the growth rate could be north of 60% if Tesla Model 3 deliveries achieve targets and sales of the Bolt, Prius Prime, Nissan LEAF and others are strong.

EV Sales Data Source: InsideEVs | Chart: EVAdoption.com

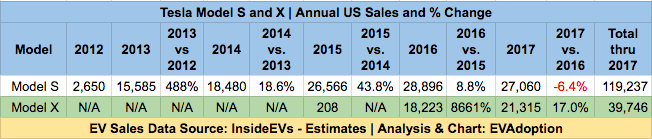

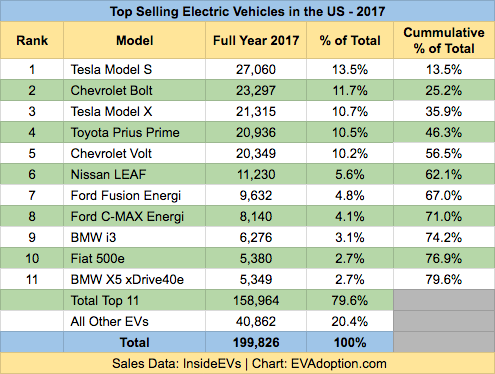

4. Sales of Tesla Model S Decline, While the Model X Begins to Close the Gap: While still the top selling EV in the US (at least according to InsideEV estimates – Tesla does not break out sales by geographic market), sales of the Tesla Model S declined more than 6.4% in 2017. Reasons for the sales decline for the Model S likely include: Buyers waiting for the Model 3 instead; the lower-cost versions of the S going away; people opting for the Model X instead; and the general decline in sales of sedans versus SUVs and crossovers.

While Model X sales increased nearly 17% from 2016, it was still about 5,700 units less than its sedan sibling. 2018 could see sales of the Model X catch up to the Model S as many buyers looking for an electric sedan opt for the smaller and less expensive Model 3.

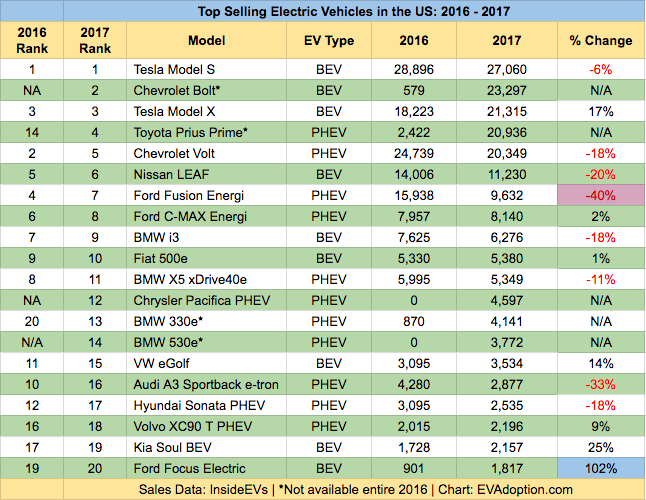

5. Eight of Top 20 Selling EVs Saw A Sales Decline in 2017 Versus 2016: Perennial EV sales leaders including the Nissan LEAF, Chevrolet Volt, BMW i3 and Ford Fusion Energi saw significant sales declines in 2017. The Tesla Model S also declined 6.4%, but the Volt was down 18%, the LEAF declining 20% and Fusion Energi dropped 40%.

The LEAF’s decline is easy to explain: The Bolt with roughly double the range of the LEAF became the go to affordable BEV. Nissan also announced a redesigned and better looking (in most people’s view) LEAF that will arrive in 2018 with 150 miles of range, versus the current 107.

On the positive side, the short-range Ford Focus saw the largest increase at 102%, followed by the Kia Soul BEV at 25% and Tesla Model X at 17%.

6. Chrysler Pacifica PHEV a Huge and Perhaps Surprising Success: If the Pacifica PHEV had been available the entire year and had not suffered a recall and short halt in sales, it most likely would have finished 2017 in 10th spot and ahead of the Fiat 500e. With no other plug in electric minivan on the market and a solid advertising campaign in California in place, the Pacifica could be a consistent top-10 selling EV in 2018.

In December, the PHEV version accounted for 6.4% of the Pacifica sales volume, suggesting that there is significant growth potential for the PHEV version in 2018. And of the 8 minivans available in the US, the Pacifica was the only one with higher sales in 2017 versus 2016. Sales overall for minivans were down 12.4% versus 2016.

7. Toyota Prius Prime Becomes America’s Favorite PHEV: A bit of a surprise, the Prius Prime PHEV ended 2017 with about 600 more units sold than the Chevrolet Volt. This despite the Volt’s range of 53 miles in electric mode, double that of the Prius Prime’s 25.

But with the Volt’s longer battery range comes a roughly $6,000 higher price tag. The Volt has an MSRP of $33,220, while the Prius Prime has a base MSRP price of $27,100. That price differential combined with Toyota’s quality manufacturing reputation and the legacy Prius hybrid’s symbol of conspicuous conservation are likely key contributors for the Prime taking top honors. The other factor of course is that Chevrolet’s BEV Bolt also competes with the Volt for customers.

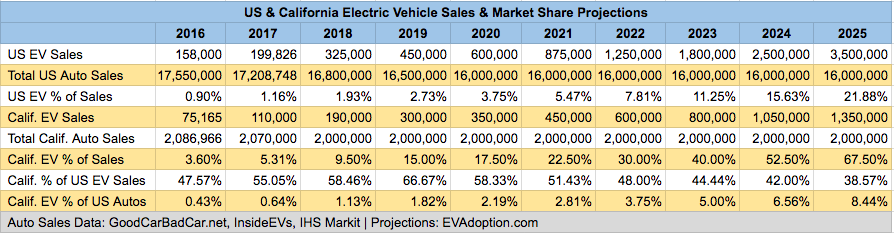

8. EV Sales as Percent of Total Sales Increases: EV sales were 1.16% of total sales with 199,826 EVs purchased in the US in 2017, out of total passenger vehicle sales of 17,208,748 passenger vehicles. In 2018 US auto sales are expected to decline to perhaps 16.8 million while EV sales could reach 325,000 or more if Tesla Model 3 deliveries ramp up and approach 2% of all auto sales.

9. 11 EVs Comprise 80% of Sales: Out of the 38 EVs currently available in the US, the top 11 (29%) account for 80% of the total sales. And the top 6 sellers delivered 62.1% of total EV sales. With the addition of the Tesla Model 3, the new Nissan LEAF and continued strong sales of the Chevrolet Bolt and Toyota Prius Prime – the top 6 vehicles could account for around 70% of total EV sales in 2018.

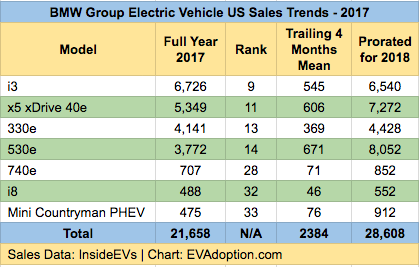

10. BMW Group Is On the Move: While sales of the BMW all-electric i3 has been slowing, 3 of the German auto maker’s 6 EVs sold in the US are climbing the sales rank ladder fairly strongly. Both the 530e and 330e will likely jump over the i3 by the end of 2018, with at least one of the two PHEVs likely cracking the top 10. The BMW Group’s 28,608 EVs sold in 2017 put them in third place after Tesla at 50,147 and GM at 43,893.

2017 was an exciting year in the progression of EVs toward mass adoption, but sales for many EV models was down or flat. In 2018 look for a significant shake up in the EV sales ranking with several long-time top sellers dropping out of the top 10-15.