Will vehicle range be the biggest hurdle to achieving adoption of electric vehicles by late adopters and laggards in the US?

Cost of EVs, availability of attractive models of the type US consumers want (SUVs, CUVs, pickups), adequate charger availability and acceptable charging times should arrive in the next 10 years. And an average range of 300 or so miles for battery electric vehicles (BEVs) should arrive by around 2022 and be an acceptable range for early adopters and early majority consumers.

But to achieve adoption by the late majority and laggards, EVs will likely need a range of 500 miles. I will explore this idea in a future article, but first let’s look at where we are currently and how far we have to go to match the range of gas vehicles.

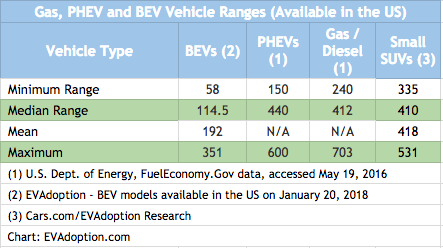

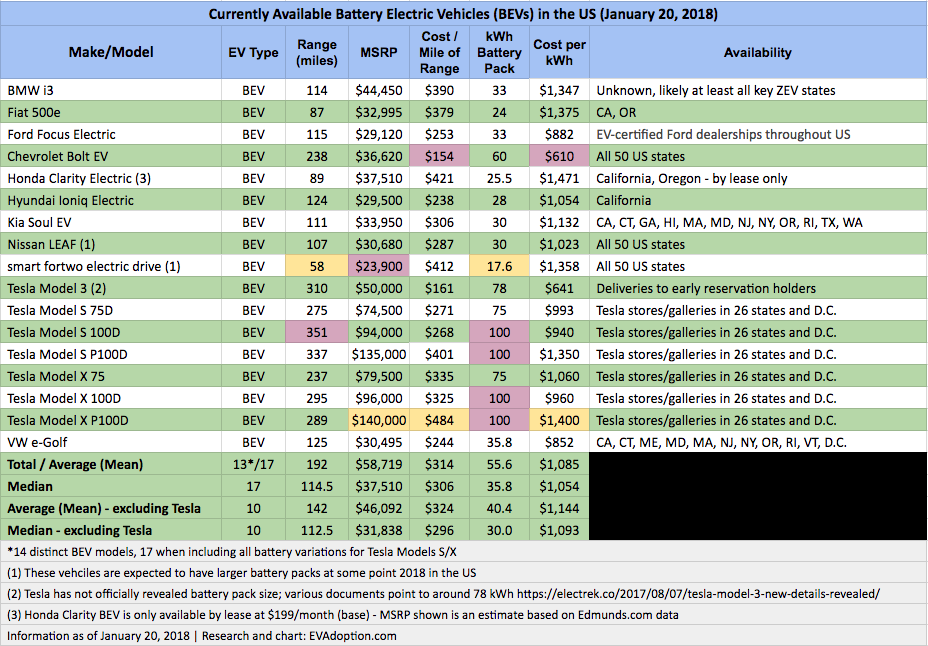

Like EVs, vehicle range of gas-powered vehicles varies widely, but according to US Department of Energy data for 2016 model vehicles, the median range is 412 miles. To compare and validate this data, I analyzed the range of 32 small 2016 SUVs and found a similar median range of 410 miles and mean of 418. Among these 32 SUVs, 81% have a range of 375 or more miles and 68% have a range at or above 375 miles.

By comparison, the current median range of the 13 BEVs (17 including all battery pack versions of Tesla models) available in the US is 114.5 miles, while the mean is 192. And if you exclude Tesla models from this, then mean and median range drops to 142 and 112.5 miles respectively.

This means that in early 2018 there is basically an average (median) range shortfall of 300 miles when comparing BEVs to gas/diesel-powered vehicles. And when comparing BEVs to PHEVs the average shortfall increases to 325 miles. As mentioned earlier, I estimate a median range for BEVs of just under 300 miles by 2022, however, that will still be roughly 110 miles fewer than gas-powered vehicles.

Now, you can argue until you are blue in the face that most Americans only use a range of 400+ miles during their few long-range trips a year and so a shorter range should suffice. However, there is a large segment of the US population who take multiple long trips per year or who will simply compare straight up the range of their ICE vehicle to that of a BEV. And for them, unless the range of an EV is higher – perhaps at least 500 miles – they will not be motivated to give up their ICE vehicle.

In future articles I’ll explore the differing range expectations and acceptance for early adopters versus the early and late majority/laggard customer segments. And I’ll outline a concept of range trifurcation in the EV market based on three range requirements for different types of consumers.

10 Responses

Dear Loren,

Thanks for a great article. Do you have any recent updates on your analysis? It will be interesting to know if your view has changed since 2018, given rapid developments in battery technology.

I also have another question about the highway range — Car and Driver recently pointed out that ICE vehicles regularly beat their EPA highway ranges in their 75-mph test, while EV ranges at highway speed are often much lower than their EPA ranges. How will this difference in highway ranges between ICE vehicles and BVE impact EV adoption? Your insight will be greatly appreciated!

I have routine driven straight through from Indiana to Oklahoma, just over 12 hours. Using an EV, this same trip would take 2 plus days in order to recharge the batteries. These EV’s will have a detrimental effect on business and personal travel.

Victor, first if you drive 12 hours without stopping – at 70 MPH, that is 840 miles. Very few cars/trucks have more than 500 miles of range (some do of course) – but most are at about 400 mile range – which means you would have to stop twice on the trip. Secondly, driving 12 hours without stopping is not safe, not health for your body, and I guess you relieve yourself in a bottle along the way?

That said, a BEV may not be for you – so might consider a PHEV. You can drive most of your local trips around town in electric mode, and the use the gas engine on road trips.

That said, your math is wrong. I’ve done about 10 road trips of about 500 miles each way in our BEV and it has only added 30-60 minutes to our trip compared to a gas car. We stop to use the restroom and have a nice breakfast, lunch or dinner, or get coffee and a snack – generally as we would do in a gas car. We might stay a bit longer or stop 1 time to charge that we wouldn’t stop in a gas car – but I enjoy our road trips more now because we actually choose to stop and have nice meals instead of eating crap and racing to get back on the road. But again, that probably isn’t for you – so maybe go with a regular hybrid and PHEV.

I believe is range is an important factor. When people need to go on a long trip, they are not going all of a sudden say they will be ok with a short range ev. Imagine going one of your regular thanksgiving or Christmas trip out of town as a family with children (you need a reliable car on hand) I heard people suggest to rent an ICE car for those occasions, but try renting a car during the holiday season is very difficult.

Why would EVs need 25% more range than gas powered vehicles? Infrastructure is getting remarkably better all the time, so perhaps your view has changed on this?