Don’t panic. Yes, the US January electric vehicle sales numbers overall and for many popular models are down significantly compared to December of 2017 – but this is actually a normal seasonal trend.

Using InsideEVs Sales Scorecard, I’ve taken a look at the January sales numbers and share 7 sales trends:

1. Low January Numbers – Just Like the Weather, January Lows Are Normal Every Year: While many in the media are speculating on what happened to sales of EVs like the Chevrolet Bolt in January, the fact is that January EV sales have been significantly lower than the previous month of December every year since 2012.

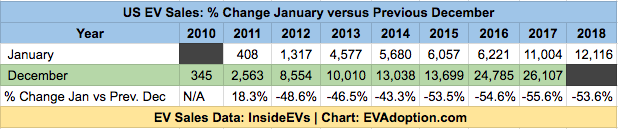

As you can see from the chart below, January sales have ranged from a low of 2014’s 43.3% lower than the previous month of December 2013 to a high of 55.6% in 2017. January 2018 was 53.6% lower than December 2017 – which is consistent with each year since 2015.

The January over December decline is not unique to the EV category as this trend for US auto sales overall tends to occur every year and sales this January were 28% lower than December 2017. The ongoing larger decline for EVs is probably partially due to buyers wanting to take advantage of available Federal and state tax credits for that tax year. The other trend you’ll notice is that sales for both January and December have increased every month since 2011, with January 2018 sales 10% higher than January 2017.

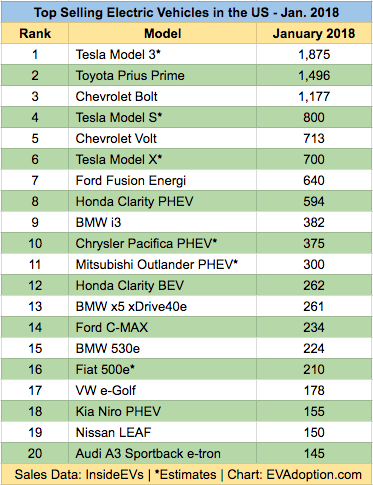

But the net, net is that we shouldn’t try to decipher too many long-term insights from the January sales numbers because they are always historically low numbers and don’t necessarily portend what will happen the rest of the year. That said, here are the top-20 selling EVs and six more potential trends to consider …

2. Tesla Model 3 – You Are, #1: While InsideEVs numbers for the Model 3 are just an estimate, they’ve been pretty accurate over the years. Because all of the other EV models had low sales numbers in January, even with the on-going production issues, the Model 3 was able to jump to the #1 position for the first time ever.

Assuming Tesla can start to scale the Model 3 in February, it should be in the number 1 position for the foreseeable future. (BTW, did anyone get the British Prisoner TV show reference in my subtitle?)

3. Bolt Sales Short Circuit from December – Don’t Worry, They’ll Jolt Back Up: I’ve seen a few articles already trying to point to causes of the Bolt’s decline to 1,177 units in January from 3,227 in December, a decline of 63.5 percent. While this drop is very significant and higher than than 53.6 percent overall EV sales decline, Bolt’s December sales were partially driven by initial concerns over the potential loss of the Federal tax credit and a lot of press around Tesla Model 3 production delays.

I expect Bolt sales to rebound to about the 2,500 unit level in the next few months, but new competitors could put a cap on sales increasing continuously as they did since April through December in 2017. In particular, the new Nissan LEAF with 150 miles of range, the Kia Niro PHEV, Honda Clarity PHEV and even the Mitsubishi Outlander PHEV all could steal up to a few hundred buyers each month from the Bolt.

And finally, if Tesla can start to scale up production of the Model 3 in February and March, many potential Bolt buyers might decide to hold off and wait for their Model 3 reservation to convert into a configuration notice.

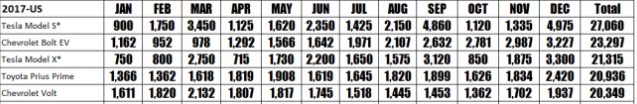

4. Toyota Prius Prime – America’s Prime Choice for a PHEV: Beginning in July of 2017, the Prius Prime PHEV has outsold the Chevrolet Volt every month (see chart above). The trend continued in January, but sales of the Prius Prime were more than double that of the Volt – its biggest margin ever. The margin of difference may not be as large going forward, but it is clear that Americans much prefer the green signaling brand and quality reputation that comes with a Toyota Prius over the longer electric range of the Chevrolet Volt.

5. Nissan LEAF Has Fallen Far From the Top of the EV Tree: In January, the Nissan LEAF sold a pathetic (for it) 150 units, the 19th ranked EV for the month. This is a huge fall for the LEAF which has ranked at or near the top of the sales list since 2010. This drop was not unexpected, however, as interested LEAF buyers are anxiously awaiting for the new redesigned (better looking by most accounts) and longer range (151 versus 107 miles) 2018 model.

It is unclear if very many 2018 models were available at dealers in January, but we should start to have a solid sense of market response to the new LEAF after the March numbers are released and dealer availability on the new model expands. I’ll be surprised if the LEAF does not jump back into the top 5 ranking within the next 2-3 months.

6. Chrysler Pacifica PHEV – This Van Is Rockin’, Don’t Bother Knocking It: The Chrysler Pacifica PHEV minivan is the only electric minivan model available in the US and continues a trend of strong sales. The Pacifica, even with only 9 months of real availability, finished 2017 in 12th place. While new electric models such as the Kia Niro PHEV, Mitsubishi Outlander PHEV and Honda Clarity PHEV may outsell the Pacifica in 2018, it has to be considered a huge success and should finish 2018 in or near the top 10 in sales.

7. New Kids on the Block – Hits In the Making?: The Mitsubishi Outlander PHEV, long available and a huge success in Europe, finally reached dealers in the US beginning in December 2017. Reaching the #11 spot in its second month of availability looks promising and I wouldn’t be surprised to see it jump up a couple of spots in the next few months. While they appeal to somewhat different buyers, it will be interesting to see if the Pacifica and Outlander end up in a bit of a sales battle for the #9 and #10 spots in 2018.

The other new entrants to watch are the Kia Niro PHEV and both the BEV and PHEV versions of the Honda Clarity. While only ranked #18 in its first month on the market with 155 models sold, I expect the Niro to jump up into or near the top 10 in sales because of its affordable pricing and crossover styling.

While they don’t particularly stand out from the competition in styling and performance, both electric versions of the Clarity are apparently available in some attractive leases in the $200/month range, which should drive some solid future sales volume. That said, the BEV version has only 89 miles of range versus the 2018 Nissan LEAF which is priced similarly at $229/month lease, but with nearly double the range at 151 miles. I expect sales of the Clarity BEV to drop to the 150 or so per month volume, but with the PHEV staying strong.

Did you see any other significant trends or disagree with my analysis? Let me know in the comments.