Analyzing EV sales numbers from InsideEVs Monthly Sales Scorecard for the month of June and YTD 2017 uncovers three key trends so far this year:

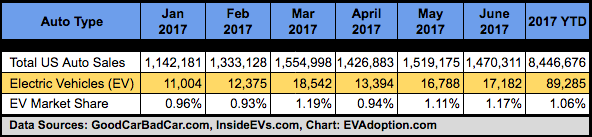

EV Sales Are Trending Above 1% of Total US Auto Sales

EV sales as a percentage of total US auto sales have surpassed 1% a few times in previous years, but fluctuated above and below this arbitrary “Mason-Dixon Line.” EV sales might now be permanently above 1%, however, with two consecutive months and 3 out of the last 4 achieving this level.

With a slowing of non EV sales combined with the Chevrolet Bolt continuing to roll out to dealers across the US, the Volt, Prius Prime and Nissan LEAF all showing strong sales – the US may never see EV sales below 1% again. And with Tesla Model 3 production about to begin, a new Nissan LEAF with longer range and increased awareness of EVs, we could reach at least 1.25% by year end and 1.5% of total auto sales in Q2 of 2018.

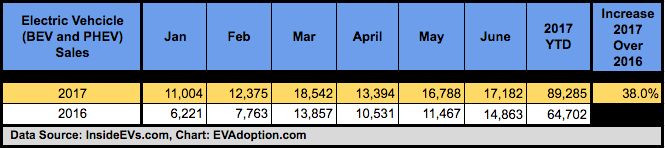

EV Sales Are Up 38% YTD Over 2016

June was a solid EV sales month at 17,182, but still about 1,400 units less than the highpoint in March of 18,542. A key trend so far in 2017 is that each month this year has been significantly higher than the same month in 2016. This is an important trend if it continues as it hasn’t always been the case in previous years.

Most noteworthy is that YTD EV sales are up 38% over 2016. If this trend continues for the rest of 2017, then year end sales would be roughly 218,887, roughly 60,000 more units than the 158,614 in 2016.

Chevrolet Bolt Surpasses Toyota Prius Prime in June – First Month Ever

June saw strong sales from all of the top contenders – Chevrolet Volt, Toyota Prius Prime, Chevrolet Bolt and Nissan LEAF. The one milestone in June is that sales of the Bolt surpassed that of the Prius Prime for the first time since both cars hit the market in late 2016.

The Volt and Prius Prime are still well ahead of the Bolt so far, but the Bolt’s trailing 2 month average is only about 150-175 units behind these two key competitors. Unless Tesla Model 3 deliveries impact Bolt sales in the coming months, the Chevrolet BEV could catch up to the Volt and Prius Prime.

| Tesla Model S* | 900 | 1750 | 3450 | 1125 | 1620 | 2350 | 1425 | 2150 | 14770 | 1685 | 1788 |

| Chevrolet Volt | 1611 | 1820 | 2132 | 1807 | 1817 | 1745 | 1518 | 1445 | 13895 | 1776 | 1482 |

| Toyota Prius Prime | 1366 | 1362 | 1618 | 1819 | 1908 | 1619 | 1645 | 1820 | 13157 | 1632 | 1733 |

| Tesla Model X* | 750 | 800 | 2750 | 715 | 1730 | 2200 | 1650 | 1575 | 12170 | 1613 | 1613 |

| Chevrolet Bolt | 1162 | 952 | 978 | 1292 | 1566 | 1642 | 1971 | 2107 | 11670 | 1429 | 2039 |

| Nissan LEAF | 772 | 1037 | 1478 | 1063 | 1392 | 1506 | 1283 | 1154 | 9685 | 1219 | 1219 |

| Ford Fusion Energi | 606 | 837 | 1002 | 905 | 1000 | 702 | 703 | 5755 | 837 | 703 | |

| Ford C-MAX Energi | 473 | 639 | 662 | 745 | 950 | 936 | 844 | 5249 | 745 | 890 | |

| Fiat 500e* | 752 | 590 | 785 | 541 | 665 | 495 | 475 | 4303 | 590 | 485 | |

| BMW i3 | 382 | 318 | 703 | 516 | 506 | 567 | 601 | 3593 | 516 | 584 |

Data Source: InsideEVs, *Estimates; Chart: EVAdoption.com

The rest of this summer will probably not see much movement among the top 10 EV sales standings as consumers wait for the roll out of the Model 3 and updated LEAF. However, we might see some aggressive lease deals from Nissan to move a lot of old LEAFs and GM to move Bolts in advance of the Model 3 rollout. Buckle up, it should be a fun rest of 2017!

Visit other EV data pages: